LensCrafters 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

point of sale, which laid the foundation for future growth. Around 700 stores were totally renovated

and 581 new points of sale were added (413 from new openings and 597 from acquisitions,

Oakley retail chains included).

The acquisition of Shoppers Optical, one of Canada’s largest optical chains with 74 stores, improved

the Group’s presence in this important market, making Luxottica the main player in the Canadian

retail prescription market segment as well as the only one with nationwide coverage. The Shoppers

Optical stores, located in eight provinces, were converted to Pearle Vision to exploit in Canada the

strength and business model of an optical retail brand long established in the United States.

In general, Luxottica Group further improved the balance and organization of its operations in

the North American market and continued to innovate. It now controls the two top retail

prescription chains (LensCrafters and Pearle Vision), it is the no. 1 operator of optical stores

under license (Licensed Brands) and recently launched ILORI, the new label with which the

Group officially entered the top end of the luxury market in response to the current trend in North

America. This new development began with the opening of the first flagship store in SoHo (NY),

followed by openings in San Francisco, Beverly Hills (LA), Chicago and other major US cities in

the second half of 2007. Luxottica plans to reach a total of 150 stores in North America in the

next three years.

Luxottica Group also has eight central lens finishing labs that are of strategic importance to its North

American retail business as well as EyeMed Vision Care, a leading administrator of managed vision

care programs for corporations, government agencies and health insurance providers in the United

States.In the sun segment, Sunglass Hut is the largest and best known chain in North America with

1,600 stores.

With its organization structure, Luxottica Group is able to quickly respond to market opportunities

and especially in the United States, where demand for fashion and luxury has grown out of cities

like New York, Miami and Los Angeles to become a nationwide cultural phenomenon.

DISTRIBUTION | 33 <

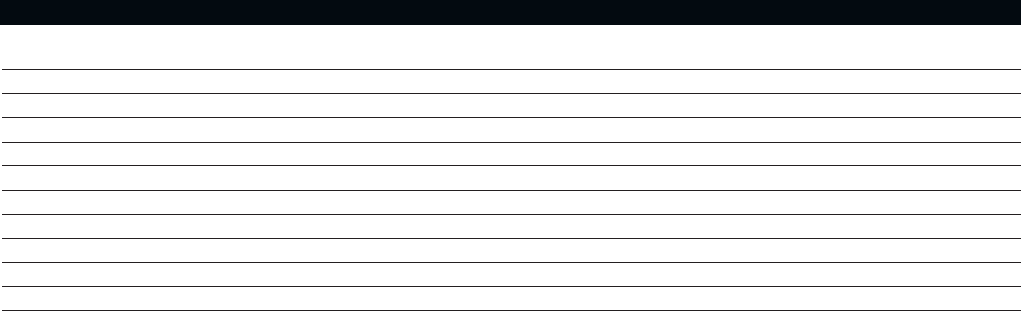

(1) Figures include results of Sunglass Hut operations from the acquisition date (March 31, 2001).

(2) Figures include results of OPSM Group operations from the acquisition date (August 1, 2003).

(3) Figures include results of Cole National operations from the acquisition date (October 4, 2004).

(4) Results of Things Remembered, Inc., a former subsidiary that was sold in September 2006, are reclassified as Discontinued operations

and are not included in results from continuing operations for 2006, 2005 and 2004.

(5) Figures do not include Oakley results.

(US$/million) First quarter Second quarter Third quarter Fourth quarter Total year

1998 280.8 278.6 298.4 270.9 1,128.7

1999 324.6 323.6 329.9 299.3 1,277.4

2000 352.1 342.9 346.0 311.1 1,352.1

2001 (1) 362.9 553.3 530.2 477.3 1,923.7

2002 516.4 553.0 556.4 479.4 2,105.2

2003 incl. 53rd week (2) 510.8 542.7 603.6 636.2 2,293.3

2003 excl. 53rd week (2) 594.5 2,251.7

2004 (3) (4) 641.5 662.7 668.3 847.3 2,819.9

2005 (4) 942.4 978.9 977.4 911.3 3,809.9

2006 (4) 1,018.1 1,054.8 1,069.2 993.2 4,135.3

2007 (5) 1,092.5 1,142.0 1,152.7 1,044.7 4,431.9

Sales of retail division 1998-2007