LensCrafters 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

> 130 | ANNUAL REPORT 2007

coverage of 12 months. Revenues from the sale of these warranty contracts are deferred and

amortized over the lives of the contracts, while costs to service the warranty claims are expensed

as incurred.

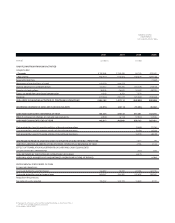

A reconciliation of the changes in deferred revenue from the sale of warranty contracts and other

deferred items for the years ended December 31, 2007 and 2006, is as follows:

The Company earns and accrues franchise revenues based on sales by franchisees which are

accrued as earned. Initial franchise fees are recorded as revenue when all material services or

conditions relating to the sale of the franchise have been substantially performed or satisfied by the

Company and when the related store begins operations. These initial franchise fees were immaterial

for the fiscal years 2007, 2006 and 2005. Accruals are established for amounts due under these

relationships when they are determined to be uncollectible.

The Wholesale and Retail Divisions may offer certain promotions during the year. Free frames given

to customers as part of a promotional offer are recorded in cost of sales at the time they are

delivered to the customer. Discounts and coupons tendered by customers are recorded as a

reduction of revenue at the date of sale.

Managed Vision Care underwriting and expenses. The Company sells vision insurance plans

which generally have a duration of up to five years. Based on its experience, the Company

believes it can predict utilization and claims experience under these plans, including claims

incurred but not yet reported, with a high degree of confidence. Claims are recorded as they are

incurred and certain other membership costs are amortized over the covered period.

Advertising and direct response marketing. Costs to develop and create newspaper, radio and

other media advertising are expensed as incurred. Costs to develop and create television

advertising are expensed the first time the airtime is used. The costs to communicate the

advertising are expensed the first time the airtime or advertising space is used with the exception

of certain direct response advertising programs. Costs for certain direct response advertising

programs are capitalized if such direct response advertising costs are expected to result in future

economic benefit and the primary purpose of the advertising is to elicit sales to customers who

could be shown to have responded specifically to the advertising. Such costs related to the direct

response advertising are amortized over the period during which the revenues are recognized, not

to exceed 90 days. Generally, other direct response program costs that do not meet the

capitalization criteria are expensed the first time the advertising occurs. Advertising expenses

incurred during fiscal years 2007, 2006 and 2005 were Euro 348.2 million, Euro 318.1 million and

Euro 267.8 million, respectively, and no significant amounts have been reported as assets.

The Company receives a reimbursement from its acquired franchisees for certain marketing costs.

Operating expenses in the Consolidated Statements of Income are net of amounts reimbursed by

the franchisees calculated based on a percentage of their sales. The amounts received in fiscal

(Euro/000) 2007 2006

Beginning balance 15,798 41,099

Translation difference (586) (3,643)

Warranty contracts sold - 30,151

Other deferred revenues - 70

Amortization of deferred revenues (15,212) (51,879)

Total -15,798

Current - 15,798

Non-current --