LensCrafters 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

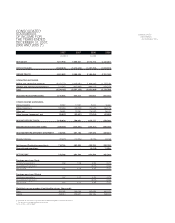

Estimated Useful Life

Buildings and building improvements 19 to 40 years

Machinery and equipment 3 to 12 years

Aircraft 25 years

Other equipment 5 to 8 years

Leasehold improvements Lesser of 15 years or the remaining life of the lease

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 127 <

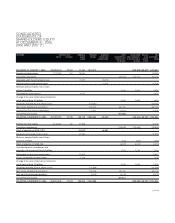

Inventories. Luxottica Group’s manufactured inventories, approximately 66.2% and 66.7% of total

frame inventory for 2007 and 2006, respectively, are stated at the lower of cost, as determined

under the weighted-average method, or market value. Retail inventories not manufactured by the

Company or its subsidiaries are stated at the lower of cost as determined by the weighted-average

cost, or market value. Inventories are recorded net of allowances for estimated losses. This reserve

is calculated using various factors including sales volume, historical shrink results and current

trends.

Property, plant and equipment. Property, plant and equipment are stated at historical cost.

Depreciation is computed on the straight-line method over the estimated useful lives of the related

assets as follows:

Maintenance and repair expenses are expensed as incurred. Upon the sale or disposition of

property and equipment, the cost of the asset and the related accumulated depreciation and

leasehold amortization are removed from the accounts and any resulting gain or loss is included in

the consolidated statement of income.

Capitalized leased property. Capitalized leased assets are amortized using the straight-line

method over the term of the lease, or in accordance with practices established for similar owned

assets if ownership transfers to the Company at the end of the lease term.

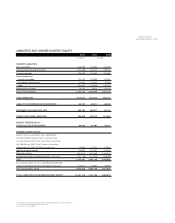

Goodwill. Goodwill represents the excess of the purchase price (including acquisition-related

expenses) over the value assigned to the net tangible and identifiable intangible assets acquired.

The Company’s goodwill is tested annually for impairment as of December 31 of each year in

accordance with SFAS No. 142, Goodwill and Other Intangible Assets (“SFAS 142”). Additional

impairment tests are performed if, for any reason, the Company believes that an event has

occurred that may impair goodwill. Such tests are performed at the reporting unit level which

consists of four units, Wholesale, Retail North America, Retail Asia Pacific and Retail Other, as

required by the provisions of SFAS 142. For the fiscal years 2007, 2006 and 2005 the Company

has not recorded a goodwill impairment charge.

Trade names and other intangibles. In connection with various acquisitions, Luxottica Group has

recorded as intangible assets certain trade names and other intangibles which the Company

believes have a finite life. Trade names are amortized on a straight-line basis over periods ranging

from 20 to 25 years (see Note 7). Other intangibles include, among other items, distributor

networks, customer lists and contracts, franchise agreements and license agreements, and are

amortized over the respective useful lives. All intangibles are subject to test for impairment in

accordance with SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets

(“SFAS 144”). Aggregate amortization expense of trade names and other intangibles for the fiscal

years 2007, 2006 and 2005 was Euro 69.5 million, Euro 68.8 million and 61.9 million, respectively.

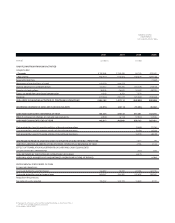

Impairment of long-lived assets. Luxottica Group’s long-lived assets, other than goodwill, are

tested for impairment whenever events or changes in circumstances indicate that the net carrying