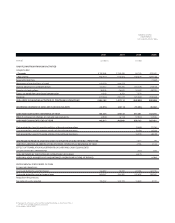

LensCrafters 2007 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS | 133 <

Net periodic pension benefit cost/(income) is recorded in the consolidated statements of income

and includes service cost, interest cost, expected return on plan assets, amortization of prior service

costs/(credits) and (gains)/losses previously recognized as a component of gains and (losses) not

affecting retained earnings and amortization of the net transition asset remaining in accumulated

gains and (losses) not affecting retained earnings. Service cost represents the actuarial present

value of participant benefits earned in the current year. Interest cost represents the time value of

money cost associated with the passage of time. Certain events, such as changes in employee

base, plan amendments and changes in actuarial assumptions, result in a change in the benefit

obligation and the corresponding change in the gains and (losses) not affecting retained earnings.

The result of these events is amortized as a component of net periodic cost/(income) over the

service lives of the participants.

Information expressed in US Dollars. The Company’s consolidated financial statements are

stated in Euro, the currency of the country in which the parent company is incorporated and

operates. The translation of Euro amounts into US Dollar amounts is included solely for the

convenience of international readers and has been made at the rate of Euro 1 to US Dollar 1.4603.

Such rate was determined by using the noon buying rate of the Euro to US Dollar as certified for

customs purposes by the Federal Reserve Bank of New York as of December 31, 2007. Such

translations should not be construed as representations that Euro amounts could be converted

into US Dollars at that or any other rate.

Reclassifications. The presentation of certain prior year information has been reclassified to

conform to the current year presentation.

Recent accounting pronouncements.

In March 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 161,

Disclosures about Derivative Instruments and Hedging Activities - an amendment of FASB

Statement No. 133 ("SFAS 161"). SFAS 161 changes the disclosure requirements for derivative

instruments and hedging activities. Entities are required to provide enhanced disclosures about (a)

how and why an entity uses derivative instruments, (b) how derivative instruments and related

hedged items are accounted for under SFAS 133 and its related interpretations, and (c) how

derivative instruments and related hedged items affect an entity's financial position, financial

performance, and cash flows. The guidance in SFAS 161 is effective for financial statements issued

for fiscal years and interim periods beginning after November 15, 2008, with early application

encouraged. This Statement encourages, but does not require, comparative disclosures for earlier

periods at initial adoption. The Company is currently assessing the impact of SFAS 161.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated

Financial Statements - an amendment to ARB No. 51, establishing new accounting and reporting

standards for noncontrolling interests (formally known as “minority interests”) in a subsidiary and,

when applicable, how to account for the deconsolidation of such subsidiary. The key differences

include that non-controlling interests will be recorded as a component of equity, the consolidated

income statements and statements of comprehensive income will be adjusted to include the non

controlling interest and certain disclosures have been updated. The statement is effective for the

fiscal years and interim periods within those years beginning on or after December 15, 2008. Earlier

adoption is prohibited. The Company has minority interests in certain subsidiaries and as such is

currently evaluating the effect of adoption.

In December 2007, FASB issued SFAS No. 141(R), Business Combinations Revised (“SFAS

141(R)”), which revises the current SFAS 141. The significant changes include a change from the

“cost allocation process” to determine the value of assets and liabilities to a full fair value