LensCrafters 2007 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2007 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178

|

|

> 144 | ANNUAL REPORT 2007

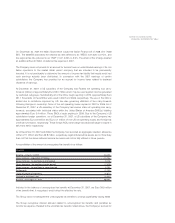

The 2007 tax benefit of 5.3%, relates to the business reorganization of certain Italian companies

which results in the release of deferred tax liabilities and is partially offset by the increase by 2.1%

in the 2007 tax charge due to the change in the Italian statutory tax rates which results in the

reduction of deferred tax assets.

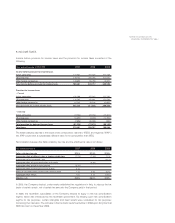

The deferred tax assets and liabilities as of December 31, 2007 and 2006, respectively, were

comprised of:

Year ended December 31 2007 2006

(Euro/000)

Deferred income tax assets

Inventory 73,062 65,192

Insurance and other reserves 10,238 14,947

Loss on investments - 1,094

Right of return reserve 13,464 8,934

Deferred revenue extended warranty contracts 824 7,192

Net operating loss carryforwards 45,224 44,449

Recorded reserves 1,381 4,318

Occupancy reserves 14,681 11,616

Employee-related reserves (including pension liability) 48,977 39,374

Trade name 72,686 84,013

Other 26,693 1,900

Fixed assets 24,472 28,211

Total deferred tax assets 331,702 311,240

Valuation Allowance (27,088) (29,781)

Net deferred tax assets 304,614 281,458

Deferred income tax liabilities

Trade name (216,997) (113,448)

Equity revaluation step-up (40,950)

Other intangibles (117,975) (65,412)

Dividends (11,933) (13,308)

Other (20,342) (1,663)

Total deferred income tax liabilites (367,247) (234,782)

Net deferred income tax assets/(liabilities) (62,633) 46,676

Deferred income tax assets have been classified in the consolidated financial statements as follows:

Deferred income tax assets - current 117,853 96,595

Deferred income tax assets - non current 67,891 45,205

Deferred income tax liabilities - non current (248,377) (95,124)

(62,633) 46,676