LensCrafters 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

INDEPENDENT AUDITORS’ REPORT

97

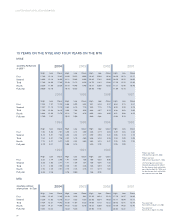

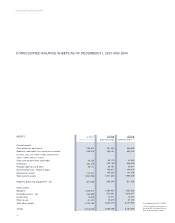

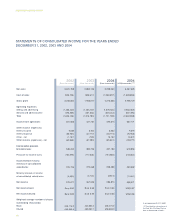

STATEMENTS OF CONSOLIDATED SHAREHOLDERS’ EQUITY

Balances, January 1, 2002

Exercise of stock options

Translation adjustment

Minimum pension liability,

less taxes of Euro 15.8 million

Tax benefit on stock options

Sale of treasury shares, net

of taxes of Euro 5.5 million

Purchase of treasury shares

Change in fair value of derivative

instruments, net of taxes of Euro 3.6 million

Dividends declared (Euro 0.17 per share)

Net income

Comprehensive income

Balances, December 31, 2002

Exercise of stock options

Translation adjustment

Minimum pension liability,

net of taxes of Euro 0.7 million

Tax benefit on stock options

Purchase of treasury shares

Change in fair value of derivative

instruments, net of taxes of Euro 0.4 million

Dividends declared (Euro 0.21 per share)

Net income

Comprehensive income

Balances, December 31, 2003

Exercise of stock options

Translation adjustment

Minimum pension liability, net

of taxes of Euro 0.2 million

Tax benefit on stock options

Change in fair value of derivative

instruments, net of taxes of Euro 0.2 million

Dividends declared (Euro 0.21 per share)

Net income

Comprehensive income

Balances, December 31, 2004

Comprehensive income (US$/000) (1)

Balances, December 31, 2004

(US$ thousands)

In accordance with U.S. GAAP

In thousands of Euro, unless

otherwise indicated

27,172

84

27,256

13

27,269

43

27,312

36,975

Amount

Common stock

452,865,817

1,397,783

454,263,600

213,433

454,477,033

728,440

455,205,473

455,205,473

Shares

18,381

9,483

3,894

6,935

38,693

1,476

254

40,423

5,950

794

47,167

63,855

Additional

paid-in

capital

1,152,508

(77,211)

372,077

1,447,374

(95,405)

267,343

1,619,312

(94,113)

286,874

1,812,073

2,453,184

Retained

earnings

147,116

(202,357)

(26,569)

10,929

(70,881)

(169,307)

(1,228)

(1,067)

(242,483)

(79,897)

248

1,174

(320,958)

(434,513)

Accumulated

other compre-

hensive income

(loss) net of tax

(202,357)

(26,569)

10,929

372,077

154,080

(169,307)

(1,228)

(1,067)

267,343

95,741

(79,897)

248

1,174

286,874

208,399

282,131

(2,334)

2,334

(24,547)

(24,547)

(45,440)

(69,987)

(69,987)

(94,748)

Treasury

shares amount,

at cost

(1,342,843)

9,567

(202,357)

(26,569)

3,894

9,269

(24,547)

10,929

(77,211)

372,077

1,417,895

1,489

(169,307)

(1,228)

254

(45,440)

(1,067)

(95,405)

267,343

1,374,534

5,993

(79,897)

248

794

1,174

(94,113)

286,874

1,495,607

2,024,753

Consolidated

shareholders’

equity

Other

comprehensive

income (loss)

net of tax