LensCrafters 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

On a consistent basis, including OPSM Group results

for 2003 and Cole National results for the first quarter

of 2003, and eliminating the 53rd week, income from

operations in 2004 over 2003 would have risen 12.7%.

The 12.7% increase was attributable to the increase in

retail sales in North America, partially offset by the

depreciation of the U.S. Dollar, as previously

mentioned.

LIQUIDITY

AND FINANCIAL RESOURCES

Luxottica Group finances regular operations and

commercial expansion primarily through internally

generated funds, trade credits and bank loans. Bank

debt consists of overdrafts and lines of credit opened

by Luxottica Group and certain of its subsidiaries with

local credit institutions. These credit facility

agreements are short term and include automatic

renewal clauses requiring short periods of advance

notification. Some of these agreements require

guarantees by Luxottica Group S.p.A. Interest rates on

these lines of credit vary according to the currency in

which the financing has been secured. Luxottica

Group uses these short-term lines of credit to meet

short-term financial needs.

In order to refinance an existing Eurobond issue, in

June of 2002, Luxottica U.S. Holdings Corp. (“U.S.

Holdings”), a wholly-owned U.S. subsidiary, entered

into a US$ 350 million credit facility agreement with

a group of four Italian banks led by UniCredito

Italiano S.p.A. The credit facility was guaranteed by

Luxottica Group S.p.A. and matures in June 2005.

The term loan portion of the credit facility provided

US$ 200 million, to be repaid in equal, quarterly

principal installments beginning in March 2003. The

revolving loan portion of the credit facility allows for

a maximum borrowing of US$ 150 million, which

may be repaid and renewed until final maturity. This

credit facility allows U.S. Holdings to select interest

periods of one, two or three months. Interest

accrues under the credit facility at LIBOR plus 0.5%

(2.92% for the term loan and 2.917% for the

revolving loan, on December 31, 2004). The credit

facility contains certain financial and operating

covenants; Luxottica Group was compliant with

these covenants as of December 31, 2004. Under

this credit facility, US$ 170 million was outstanding

as of December 31, 2004.

In July 2002, U.S. Holdings entered into a Convertible

Swap Step-Up (“2002 Swap”). The 2002 Swap has

an aggregate maximum notional amount of US$ 275

million which provided for a decrease of US$ 20

million every three months starting March 17, 2003.

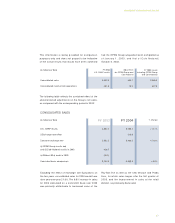

The following table summarizes the impact of the

acquisition of OPSM Group, the acquisition of Cole

National, and the 53rd week on consolidated

income from operations in order to facilitate their

comparison with 2004 on a consistent basis.

U.S. GAAP results

% of sales

ii) OPSM Group results

and iii) Cole National results in 2003

iv) Without 53rd week in 2003

Consistent basis comparison

% of sales

431.8

15.1%

15.2

(9.6)

437.4

13.5%

492.8

15.1%

492.8

14.2%

+ 14.1%

+ 12.7%

In millions of Euro

CONSOLIDATED INCOME FROM OPERATIONS

FY 2004 % change

FY 2003

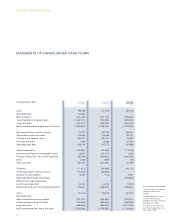

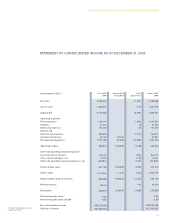

MANAGEMENT’S DISCUSSION AND ANALYSIS