LensCrafters 2004 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

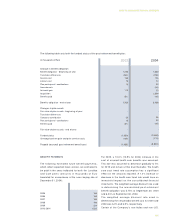

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

136

subsidiaries provide limited non-pension benefits to

retirees in addition to government sponsored

programs. The cost of these programs is not

significant to the Company.

10. STOCK OPTION

AND INCENTIVE PLANS

STOCK OPTION PLAN

Beginning in April 1998, certain officers and other key

employees of the Company and its subsidiaries were

granted stock options of Luxottica Group S.p.A. under

the Company’s stock option plan. The stock options

were granted at a price equal to the market value of

the shares at the date of grant. These options become

exercisable in three equal annual installments from the

date of grant and expire on or before January 31,

2012.

As Luxottica Group has elected to apply APB 25, no

compensation expense was recognized because the

option exercise price was equal to the quoted market

value on the date of grant.

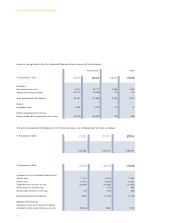

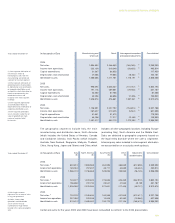

The following table summarizes information about

stock options for each year:

Outstanding as of January 1, 2002

Granted

Forfeitures

Exercised

Outstanding as of December 31, 2002

Granted

Forfeitures

Exercised

Outstanding as of December 31, 2003

Granted

Forfeitures

Exercised

Outstanding as of December 31, 2004

7,407,783

2,348,400

(248,367)

(1,397,783)

8,110,033

2,397,300

(176,600)

(213,433)

10,117,300

2,035,500

(70,300)

(728,440)

11,354,060

Number of options

outstanding

9.67

16.98

14.54

6.67

11.51

10.51

11.77

6.97

10.29

13.79

9.73

8.07

10.74

Weighted average exercise price

(in Euro) (1)

(1) For convenience all amounts

are translated at the noon

buying rate in effect at the end of

each year.

(2) Certain options were granted

in U.S. Dollars and have been

converted using a December 31,

2004 conversion rate of Euro

1.00 to US$ 1.3538.

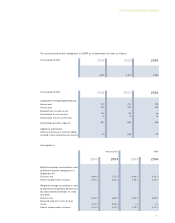

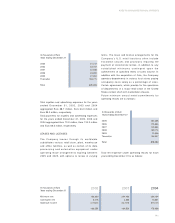

1

2

3

4

5

6

7

Grant

807,250

1,161,960

1,292,700

1,669,850

2,150,700

2,236,100

2,035,500

Number outstanding

7.38

4.38

9.52

11.23

13.15

10.51

13.79

Exercise price

(in Euro) (2)

807,250

1,161,960

1,292,700

1,669,850

1,429,000

689,100

0

Number exercisable

2.1

3.1

4.1

5.1

6.1

7.1

8.1

Remaining life (years)

Stock option grants outstanding at December 31, 2004 are summarized as follows:

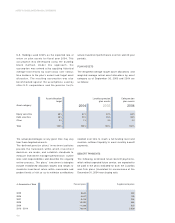

Included as an addition to the Company’s paid-in capital

account in fiscal years 2003 and 2004 is Euro 0.3 million

and Euro 0.8 million, respectively, of tax benefits the

Company received from employees exercising these

stock options.