LensCrafters 2004 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

112

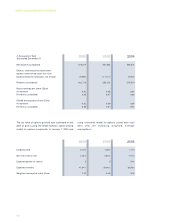

3. INVENTORIES

Inventories consisted of the following:

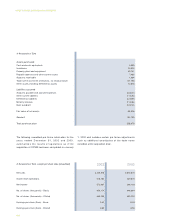

4. ACQUISITIONS

AND INVESTMENTS

A) SUNGLASS HUT INTERNATIONAL, INC.

On February 20, 2001, Luxottica Group formed an

indirect wholly-owned U.S. subsidiary, Shade

Acquisition Corp., for the purpose of making a

tender offer for all the outstanding common stock of

Sunglass Hut International, Inc. (“SGHI”), a publicly

traded company on the NASDAQ National Market.

The Tender Offer commenced on March 5, 2001 and

was completed on March 30, 2001. On April 4,

2001, Shade Acquisition Corp. was merged with and

into SGHI and SGHI became an indirect wholly-

owned subsidiary of the Company. As such, the

results of SGHI have been consolidated into the

Company’s consolidated financial statements as of

the acquisition date. The acquisition was accounted

by using the purchase method, and accordingly, the

purchase price of Euro 558 million (including

approximately Euro 33.9 million of direct acquisition-

related expenses) was allocated to the assets

acquired and liabilities assumed based on their fair

value at the date of the acquisition. The Company

uses many different valuation techniques to

determine the fair value of the net assets acquired

including but not limited to discounted cash flow

and present value projections. Intangible assets are

recognized separate from goodwill if they arise from

contractual or other legal rights or if they do not meet

the definition of separable as noted in APB No. 16,

Business Combinations, subsequently superseded

by SFAS No. 141, Business Combinations (“SFAS

141”). As a result of the final valuations, which were

completed in March 2002, the aggregate balance of

goodwill and other intangibles previously recorded

as of December 31, 2001 increased by

approximately Euro 147 million during the year

ended December 31, 2002. The excess of purchase

price over net assets acquired (“goodwill”) has been

recorded in the accompanying consolidated

balance sheet.

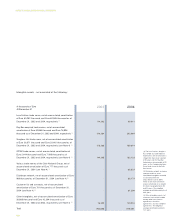

The purchase price and expenses have been

allocated based upon the valuation of the

Company’s acquired assets and liabilities assumed

as follows:

Raw materials and packaging

Work in process

Finished goods

Total

In thousands of Euro

At December 31

62,209

25,363

316,644

404,216

2003

50,656

24,486

358,016

433,158

2004