LensCrafters 2004 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

107

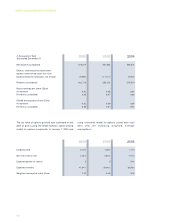

Weighted average shares outstanding -

basic

Effect of dilutive stock options

Weighted average shares outstanding -

dilutive

Options not included in calculation of

dilutive shares as the exercise price was

greater than the average price during the

respective period

In thousands

453,174.0

2,179.5

455,353.5

1,974.7

2002

448,664.4

1,537.7

450,202.1

4,046.6

2003

448,275.0

2,085.9

450,360.9

2,169.6

2004

FAIR VALUE OF FINANCIAL INSTRUMENTS

Financial instruments consist primarily of cash and

cash equivalents, marketable securities, trade account

receivables, accounts payable, long-term debt and

derivative financial instruments. Luxottica Group

estimates the fair value of financial instruments based

on interest rates available to the Company and by

comparison to quoted market prices, when available.

At December 31, 2003 and 2004, the fair value of the

Company’s financial instruments approximated the

carrying value.

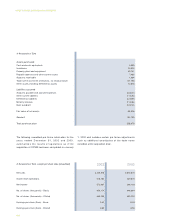

STOCK-BASED COMPENSATION

The Company has elected to follow the accounting

provisions of Accounting Principles Board (“APB”)

Opinion No. 25, Accounting for Stock Issued to

Employees (“APB 25”) for stock-based

compensation and to provide the disclosures

required under SFAS No. 123, Accounting for Stock-

Based Compensation, as amended by SFAS No.

148, Accounting for Stock-based Compensation -

Transition and Disclosure (collectively, “SFAS 123”)

(see Note 10). No stock-based employee

compensation cost is reflected in net income, as all

options granted under the plans have an exercise

price equal to the market value of the underlying

stock on the date of the grant. The Company

changed its method to value options issued after

January 1, 2004 from the Black-Scholes model to a

binomial model as the Company believes a binomial

valuation technique will result in a better estimate of

the fair value of the options. The following table

illustrates the effect on net income and earnings per

share had the compensation costs of the plans been

determined under a fair-value based method as

stated in SFAS 123: