LensCrafters 2004 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROFILE OF LUXOTTICA GROUP

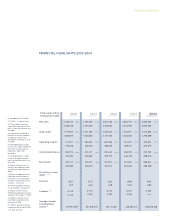

FINANCIAL HIGHLIGHTS 2000-2004

In accordance to U.S GAAP

(1) 1 ADS = 1 ordinary share.

(2) These figures have been

retroactively adjusted to reflect

the 2:1 stock split effective June

26, 2000.

(3) Proposed by the Board of

Directors and to be submitted

for approval at the Annual

Shareholders’ Meeting on June

15, 2005.

(4) 1995-2004 figures include

results of U.S. Shoe (acquired in

May 1995) and Persol S.p.A.

(acquired in April 1995)

operations.

(5) 1999-2004 figures include

results of Ray-Ban operations

from the acquisition date (June

26, 1999).

(6) Figures include results of

Sunglass Hut operations from

the acquisition date (March 31,

2001).

(7) Results for 2000 have been

calculated from the financial

statements in Lire converted at

the fixed exchange rate of Lire

1,936.27 = Euro 1.00.

(8) For the Euro/US$ exchange

rate on dividends, see page 91.

(9) Figures include results of

OPSM Group operations from the

acquisition date (August 1, 2003).

(10) Figures include results of

Cole National operations from

fourth quarter 2004.

(11) Figures adjusted to allow a

comparison with results for 2003.

(*) In Euro and US$

Net sales

Gross profit

Operating income

Income before taxes

Net income

Per ordinary share

(ADS) (1) (2) (*)

Earnings

Dividend (3) (8)

Average number

of outstanding

shares (2)

2,439,166

2,246,228

1,719,925

1,583,879

411,921

379,338

362,019

333,383

255,277

235,085

0.57

0.52

0.140

0.120

100.0%

70.5%

16.9%

14.8%

10.5%

3,105,498

2,781,594

2,181,960

1,954,382

509,492

456,352

441,311

395,282

316,373

283,375

0.70

0.63

0.170

0.165

100.0%

70.3%

16.4%

14.2%

10.2%

3,201,788

3,025,690

2,255,654

2,131,593

601,508

568,425

539,442

509,772

372,077

351,613

0.82

0.78

0.210

0.242

100.0%

70.4%

18.8%

16.8%

11.6%

2,852,194

3,224,976

1,948,577

2,203,256

431,787

488,222

389,793

440,739

267,343

302,285

0.60

0.67

0.210

0.256

100.0%

68.3%

15.1%

13.7%

9.4%

3,255,300

4,047,966

2,214,603

2,753,859

492,814

612,814

457,153

568,470

286,874

356,728

0.64

0.80

0.230

n.a.

100.0%

68.0%

15.1%

14.0%

8.8%

2000

(4) (5) (7) (11) 2001

(4) (5) (6) (11) 2002

(4) (5) (6) (11) 2003

(4) (5) (6) (9) 2004

(4) (5) (6) (9) (10)

449,987,899 451,036,978 453,174,041 448,664,413 448,275,028

9

In thousands of Euro

In thousands of US$