LensCrafters 2004 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

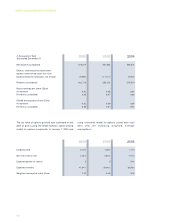

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

116

of restricted stock of Cole was approximately Euro

407.9 million (US$ 500.6 million). In connection with

the merger, the Company assumed net outstanding

indebtedness with an approximately aggregate fair

value of Euro 253.2 million (US$ 310.8 million). The

acquisition was accounted by using the purchase

method, and accordingly, the purchase price of Euro

423.7 million (US$ 520.1 million), including

approximately Euro 15.8 million (US$ 19.5 million) of

direct acquisition-related expenses, was allocated to

the assets acquired and liabilities assumed based

on their fair value at the date of the acquisition. The

Company used various methods to calculate the fair

value of the assets and liabilities and all valuations

have not yet been completed. As such, the final

allocation of assets may change during 2005. The

excess of purchase price over net assets acquired

(“goodwill”) has been recorded in the

accompanying consolidated balance sheet. The

acquisition of Cole National was made as result of

the Company’s strategy to continue expansion of its

retail business in North America.

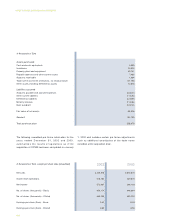

The purchase price (including acquisition-related

expenses) has been allocated based upon the

preliminary valuation of the Company’s acquired

assets and liabilities currently assumed as follows:

Assets purchased

Cash and cash equivalents

Inventories

Accounts receivable

Prepaid expenses and other current assets

Property, plant and equipment

Trade names (useful lives of 25 years, no residual value)

Distributor network (useful life of 23 years, no residual

value)

Customer list and contracts (useful life of 21-23 years, no

residual value)

Other intangibles

Asset held for sale - Pearle Europe

Other assets

Liabilities assumed

Accounts payable

Accrued expenses and other current liabilities

Deferred tax liabilities, net

Long-term debt

Bank overdraft

Other non current liabilities

Fair value of net assets

Goodwill

Total purchase price

60,762

89,631

45,759

12,503

114,385

72,909

98,321

68,385

37,122

143,617

11,299

(47,782)

(176,571)

(21,550)

(253,284)

(22,668)

(74,933)

157,905

265,835

423,740

In thousands of Euro