LensCrafters 2004 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

105

customers take receipt of products and services.

Also included in retail division revenues are managed

vision care revenues consisting of (i) insurance

revenues which are recognized when earned over the

terms of the respective contractual relationships, and

(ii) administrative services revenues which are

recognized when services are provided during the

contract period. Accruals are established for amounts

due under these relationships determined to be

uncollectible.

Cole earns and accrues franchise revenues based on

sales by franchisees which are accrued as earned.

Initial franchise fees are recorded as revenue when all

material services or conditions relating to the sale of

the franchise have been substantially performed or

satisfied by Cole and when the related store begins

operations. Accruals are established for amounts due

under these relationships determined to be

uncollectible.

The retail division also sells separately priced

extended warranty contracts with terms of coverage

of 12 to 24 months. Revenues from the sale of these

warranty contracts are deferred and amortized over

the lives of the contracts, while costs to service the

warranty claims are expensed as incurred.

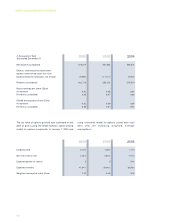

A reconciliation of the changes in deferred revenue

from the sale of warranty contracts and other deferred

items is as follows:

Beginning balance

Translation difference

Cole acquired balances

Warranty contracts sold

Other deferred revenues

Amortization of deferred revenues

Total

Current

Non-current

In thousands of Euro

845

(120)

-

-

4,319

(4,532)

512

512

-

2003

512

(3,631)

44,161

10,152

3,922

(14,152)

40,964

31,948

9,016

2004