LensCrafters 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

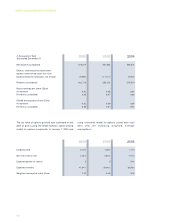

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

118

F) OTHER ACQUISITIONS AND ESTABLISHMENTS

During 2002 the Company acquired six retail

companies for an aggregate amount of Euro 35.0

million (US$ 33.5 million). All tangible assets and

liabilities assumed were insignificant individually and

in the aggregate and, accordingly, substantially the

entire purchase price was allocated to goodwill. No

pro forma financial information is presented, as the

acquisitions were not material to the Company’s

consolidated financial statements. One of these

companies is accounted for under the equity

method.

In 2003, Luxottica Holland B.V., a wholly-owned

subsidiary, acquired the remaining interest in Mirari

Japan, a wholesale distributor, for aggregate cash

consideration of Euro 18 million. The subsidiary has

been accounted for as a step acquisition and the

Company has recorded goodwill of approximately

Euro 16.9 million in connection therewith.

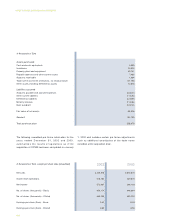

5. PROPERTY, PLANT

AND EQUIPMENT - NET

Property, plant and equipment - net consisted of the

following:

Land and buildings, including leasehold improvements

Machinery and equipment

Aircraft

Other equipment

Building, held under capital lease

Less: accumulated depreciation and amortization

Total

In thousands of Euro

416,752

428,644

25,908

268,138

2,332

1,141,774

644,339

497,435

2003

475,605

458,578

25,908

320,077

2,332

1,282,500

683,255

599,245

2004

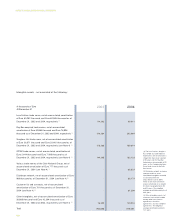

Depreciation and amortization expense relating to

property, plant and equipment for the years ended

December 31, 2002, 2003 and 2004 was Euro 103.8

million, Euro 92.2 million and Euro 101.1 million,

respectively. Included in “Other equipment” is

approximately Euro 16.5 million and Euro 26.6 million

of construction in progress as of December 31, 2003

and 2004, respectively.