LensCrafters 2004 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

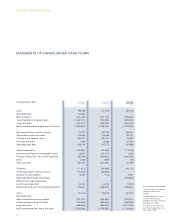

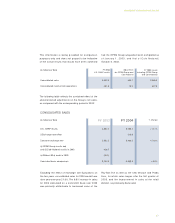

MANAGEMENT’S DISCUSSION AND ANALYSIS

62

STATEMENTS OF CONSOLIDATED CASH FLOWS

Cash

Restricted cash

Bank overdraft

Current portion of long-term debt

Long-term debt

Net financial position, beginning of the year

Net income before minority interests

Depreciation and amortization

Change in net working capital

Provision and other

Operating cash flow

Capital expenditure

(Investments)/Disposal in intangible assets

Purchase of business net of cash acquired

Other

Free cash flow

Dividends

(Purchases)/Sale of treasury shares

Exercise of stock options

Debt acquired through acquisitions

Effect of exchange adjustments

to net financial position

Decrease/(increase) in net financial position

Cash

Restricted cash

Bank overdraft and notes payable

Current portion of long-term debt

Long-term debt

Net financial position, end of the year

199,202

213,507

(411,193)

(1,339,131)

(132,247)

(1,469,862)

372,077

145,980

(83,427)

1,649

436,279

(173,330)

28,611

(35,039)

4,646

261,167

(77,211)

(15,278)

13,461

-

33,423

215,562

151,418

-

(371,729)

(178,335)

(855,654)

(1,254,300)

151,418

-

(371,729)

(178,335)

(855,654)

(1,254,300)

267,343

134,840

(95,177)

20,266

327,272

(81,288)

(48,177)

(342,933)

3,839

(141,287)

(95,405)

(45,440)

1,743

-

64,294

(216,095)

299,973

-

(516,905)

(390,935)

(862,492)

(1,470,395)

299,973

-

(516,905)

(390,935)

(862,492)

(1,470,395)

286,874

152,751

40,907

47,351

527,883

(117,420)

(301)

(362,978)

198

47,382

(94,113)

-

6,787

(275,952)

70,245

(245,651)

257,349

-

(290,531)

(405,369)

(1,277,495)

(1,716,046)

In thousands of Euro 2002

(1) 2003

(2) 2004

(2) (3)

In accordance with U.S.GAAP

(1) Figures adjusted to allow a

comparison with results

for 2003.

(2) 2003-2004 figures include

results of OPSM Group

operations from the acquisition

date (August 1, 2003).

(3) Figures include results of

Cole National operations from

fourth quarter 2004.