LensCrafters 2004 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153

|

|

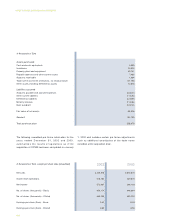

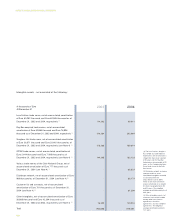

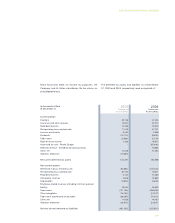

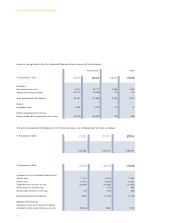

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

123

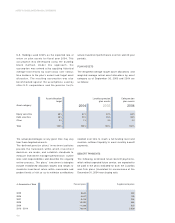

Since fiscal year 2004, for income tax purposes, the

Company and its Italian subsidiaries file tax returns on

consolidated basis.

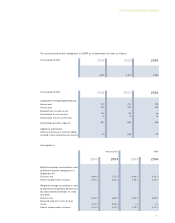

The deferred tax assets and liabilities as of December

31, 2003 and 2004, respectively, were comprised of:

Current portion

Inventory

Insurance and other reserves

Recorded reserves

Net operating loss carryforwards

Loss on investments

Dividends

Trade name

Right of return reserve

Asset held for sale - Pearle Europe

Deferred revenue - extended warranty contracts

Other, net

Valuation allowance

Net current deferred tax assets

Non-current portion

Difference in basis of fixed assets

Net operating loss carryforwards

Recorded reserves

Occupancy reserves

Depreciation

Employee-related reserves (including minimum pension

liability)

Trade name

Other intangibles

Trade mark accelerated amortization

Other, net

Valuation allowance

Net non-current deferred tax liabilities

In thousands of Euro

At December 31

29,733

13,551

17,340

71,429

5,452

(13,112)

(5,506)

1,456

-

-

14,458

(10,350)

124,451

(53,003)

81,724

5,142

4,040

(3,529)

19,042

(121,108)

(10,734)

(68,255)

11,658

(26,079)

(161,102)

2003

Deferred tax

Asset/(Liability)

47,424

27,212

10,248

47,101

3,930

(6,092)

(5,179)

10,572

(55,448)

10,508

14,232

-

104,508

(126,324)

70,071

14,305

15,558

(2,843)

28,503

(108,833)

(19,917)

(74,341)

10,767

(22,837)

(215,891)

2004

Deferred tax

Asset/(Liability)