LensCrafters 2004 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

ANNUAL REPORT 2004

Luxottica Group S.p.A. listed on the NYSE on January

23, 1990. At the time of the Initial Public Offering

10,350,000 ordinary shares were sold, equivalent to

5,175,000 American Depositary Shares (each ADS

equals two ordinary shares). The issue price was US$

19 per ADS.

In June 1992 Luxottica Group’s Board of Directors

approved a change in the conversion ratio of the ADS

from 1:2 to 1:1. The change in the conversion ratio,

effective from July 10, 1992, did not effect the number

of ordinary shares outstanding, which remained

45,050,000.

At Luxottica Group’s Extraordinary Shareholders’

Meeting on March 10, 1998, the Board of Directors

approved a five-for-one split of the Group’s ordinary

shares. This stock split increased the number of

outstanding ordinary shares from 45,050,000 to

225,250,000, and reduced the par value from Lire

1,000 to Lire 200. This stock split, effective from April

16, 1998, had no effect on the Group’s authorized

share capital, which remained Lire 45,050,000,000.

Each ADS continued to equal one ordinary share.

At Luxottica Group’s Extraordinary Shareholders’

Meeting on May 3, 2000, shareholders approved a

two-for-one stock spilt. This stock split increased the

number of outstanding ordinary shares, from

231,375,000 to 462,750,000, and reduced the par

value from Lire 200 to Lire 100. This stock split,

effective from June 26, 2000, had no effect on the

Group’s authorized share capital, which remained Lire

46,275,000,000. Each ADS continued to equal one

ordinary share.

After ten years, Luxottica Group listed on the MTA on

December 4, 2000. At the time of the Offering

10,385,000 ordinary shares were sold at Euro 16.83

per share.

Luxottica Group’s ordinary shares and ADS are traded

on both exchanges under the symbol LUX.

At Luxottica Group’s Extraordinary Shareholders’

Meeting on June 26, 2001, shareholders approved the

conversion of Luxottica Group’s authorized and issued

share capital into Euro. As a result of the conversion,

the per share par value of Luxottica Group’s ordinary

shares became Euro 0.06, from Lire 100.

On December 31, 2004 Luxottica Group’s authorized

share capital was Euro 27,312,328.38, equivalent to

455,205,473 ordinary shares.

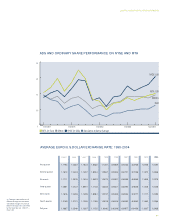

LUXOTTICA GROUP CAPITAL

STOCK INFORMATION