LensCrafters 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS

69

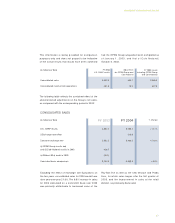

The swap will expire on June 17, 2005. The 2002

Swap was entered into to convert the floating rate

agreement to a fixed rate agreement. The 2002 Swap

allows U.S. Holdings to pay a fixed rate of interest if

LIBOR remains under certain defined thresholds and

to receive an interest payment of the three months

LIBOR rate. This amount is settled net every three

months. This derivative instrument does not qualify

for hedge accounting under Financial Accounting

Standards No. 133, and, as such, requires the

recording of any gains or losses, calculated

according to “market value” of the transaction,

directly in the consolidated income statements. In the

2003 and 2004 consolidated income statements,

gains of Euro 635 thousand and Euro 1,491 million

were reported, respectively.

In December 2002, Luxottica Group entered into a

new credit facility agreement with Banca Intesa

S.p.A. This unsecured credit facility was for a Euro

650 million line of credit. This credit facility consists

of a Euro 500 million term loan, Euro 200 million of

which was repaid in June 2004 and the remainder of

which to be paid in quarterly installments of Euro 50

million from September 2004 with interest accruing

at EURIBOR plus 0.45% (2.628% on December

2004). The Euro 150 million revolving portion of the

loan may be borrowed and repaid until the facility

agreement’s final maturity on December 27, 2005.

As of December 31, 2004, Euro 75 million of the

revolving portion was utilized. The interest accrues at

EURIBOR plus 0.45% (2.623% on December 31,

2004). This facility agreement may be renewed per

periods of one, two, or three months per the Group’s

discretion. The credit facility contains certain

financial and operating covenants. Luxottica Group

was in compliance with these covenants as of

December 31, 2004.

In December 2002, Luxottica Group entered into two

Interest Swap transactions (the “Intesa Swaps”)

beginning with an aggregate maximum notional

amount of Euro 250 million, which decrease by Euro

100 million on June 27, 2004, and by Euro 25 million

in each subsequent three-months period. The Intesa

Swaps will expire on December 27, 2005. The Intesa

Swaps were entered into a cash flow hedge on a

portion of the Banca Intesa Euro 650 million

unsecured facility discussed above. As such

changes in the fair value of the Intesa Swaps are

included in OCI until they are realized in the financial

statements. The Intesa Swaps exchange the floating

rate based on the EURIBOR for a fixed rate of

2.985% per annum.

On September 3, 2003 the U.S. Holdings subsidiary

closed a private placement of US$ 300 million of

senior unsecured guaranteed notes ("Notes"), issued

in three tranches (Series A, Series B, Series C).

Interest on the Series A Note accrues at 3.94% per

annum, while interest on Series B and Series C Notes

accrues at 4.45%. The Series A and Series B Notes

mature on September 3, 2008 and Series C Notes

mature on September 3, 2010. In accordance with

the terms of the Notes, Series A and Series C Notes

require annual repayment beginning September 3,

2006. The Notes are guaranteed by Luxottica Group

and Luxottica S.r.l., one of its subsidiaries. Under

certain circumstances, U.S. Holdings may opt to

prepay the Notes. Proceeds from the Notes were

used for the repayment of outstanding debt and for

other working capital needs.

In connection with the issue of these Notes, U.S.

Holdings entered into three Interest Rate Swaps with

Deutsche Bank AG (“DB Swap”). The notional

amounts and interest payment dates of the DB

Swaps coincide with each of the three tranches

issued. The DB Swaps were entered into to

exchange the Notes’ fixed interest rate to a floating

rate of 0.66% over the six-month LIBOR for Series A

Notes, and 0.73% over the six-month LIBOR for

Series B and Series C Notes.

In September 2003, Luxottica Group acquired

82.57% of OPSM Group ordinary shares and over

90% of the options for A$ 442.7 million (Euro 253.7

million). The purchase price was financed through

new credit facility agreements with Banca Intesa

S.p.A. for Euro 200 million, in addition to existing

lines of credit. This new financing agreement

consists of a long term loan for Euro 150 million, to

be reimbursed in Euro 30 million installments every

six months from September 30, 2006 until its final

maturity date. Interest accrues at 0.55% over the

EURIBOR (as defined in the agreement), (2.729% on

December 31, 2004). The remaining portion of the

loan consists of a revolving loan for Euro 50 million,

which may be repaid and borrowed until the