LensCrafters 2004 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

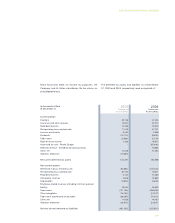

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

113

B) OPSM GROUP

In May 2003, Luxottica Group formed an indirect

wholly-owned subsidiary in Australia, Luxottica South

Pacific Pty Limited, for the purpose of making a cash

offer for all outstanding shares, options and

performance rights of OPSM Group Limited (“OPSM”),

a publicly traded company on the Australian Stock

Exchange. The cash offer commenced on June 16,

2003, received acceptances which increased

Luxottica’s relevant interest in OPSM shares to 50.68%

on August 8, 2003, and was completed on September

3, 2003. At the close of the offer, Luxottica South

Pacific held 82.57% of OPSM’s ordinary shares. As a

consequence of the acquisition, all options and

performance rights were cancelled. As a result of

Luxottica South Pacific Pty Limited acquiring the

majority of OPSM’s shares on August 8, 2003,

OPSM’s financial position and results of operations are

reported in the consolidated financial statements since

August 1, 2003. Results of operations for the seven

day period ended August 7, 2003 were immaterial.

The acquisition was accounted for in accordance with

SFAS 141, and accordingly, the purchase price of Euro

253.7 million or A$ 442.7 million (including

approximately A$ 7.2 million of direct acquisition-

related expenses) was allocated to the assets

acquired and liabilities assumed based on their fair

value at the date of the acquisition. The Company

uses many different valuation techniques to determine

the fair value of the net assets acquired including but

not limited to discounted cash flow and present value

projections. Intangible assets are recognized separate

from goodwill if they arise from contractual or other

legal rights or if they do not meet the definition of

separable as noted in SFAS 141. The valuation of

OPSM’s acquired assets and assumed liabilities was

completed in June 2004 without significant changes to

the preliminary valuation. The excess of purchase

price over the net assets acquired (“goodwill”) has

been recorded in the accompanying consolidated

balance sheet. The acquisition of OPSM was made as

a result of the Company’s strategy to expand its retail

business in Asia Pacific area.

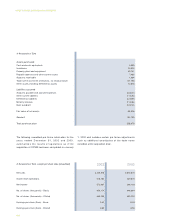

The purchase price (including direct acquisition-

related expenses) has been allocated based upon the

valuation of the Company’s acquired assets and

liabilities, assumed as follows (reported at the

exchange rate on the date of acquisition):

Assets purchased

Cash and cash equivalents

Inventories

Property, plant and equipment

Prepaid expenses and other current assets

Accounts receivable

Trade name (useful life of 25 years, no residual value)

Other assets including deferred tax assets

Liabilities assumed

Accounts payable and accrued expenses

Other current liabilities

Deferred tax liabilities

Long-term debt

Bank overdraft

Fair value of net assets

Goodwill

Total purchase price

17,023

90,034

113,212

14,717

2,161

340,858

34,657

(101,020)

(52,200)

(135,340)

(128,691)

(104,155)

91,256

466,790

558,046

In thousands of Euro