LensCrafters 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LUXOTTICA GROUP IN 2004

14

to have direct contact with new segments of the

market, improve the quality of the services it offers and

continuously improve its efficiency in logistics.

Strong in this foundation and keenly aware of how

crucial a presence in the retail sector is in the North

American market, in 2004 Luxottica Group closed the

acquisition of Cole National, the second largest player

in the sector in the U.S., owner of retail brands such as

Pearle Vision with an important network of wholly-

owned stores and in franchising, as well as the

operator of in-store optical departments Sears Optical,

Target Optical and BJ’s Optical (licensed brands).

In addition to the retail outlets, the Cole National

acquisition brought to the Group seven central labs,

which, added to the in-store labs of LensCrafters,

immediately made of the Group the operator of one of

the largest finishing lab networks in the U.S.

Finally, with the integration of Cole National’s Managed

Vision Care business into Luxottica Group’s own

EyeMed Vision Care, the Group is today the second

largest administrator of U.S. managed vision care

programs designed for corporations, government

entities and health insurance providers.

Furthermore, regarding the consolidation of its position

in the retail sector, in 2004 Luxottica Group launched a

Tender Offer for all the remaining outstanding shares of

OPSM Group (Luxottica Group had already acquired

82.57% of that company’s outstanding shares in

2003). This transaction was successfully concluded in

March 2005.

OPSM Group holds leading positions in the optical

retail markets in Australia, New Zealand and South-

East Asia. In particular, its presence in the Hong Kong

market is expected to be an important platform for

testing product mix and services in a market similar to

that of mainland China, which shows interesting

potential for growth in the optical sector.

In 2004, the integrating of OPSM Group’s

administrative and IT systems in order to maximize the

efficiency of processes, in line with Luxottica Group’s

standards, was rigorously pursued. Among other

initiatives, all OPSM Group administrative functions

were moved to a single headquarter in Australia; in

Hong Kong, a centralized sales monitoring system

was introduced at all stores.

Finally, regarding businesses already integrated into

the Group, LensCrafters continued to reap the fruits of

its focus on service and enjoyed in 2004 tremendous

success from its product selection. Sunglass Hut, on

the other hand, brought to completion the

repositioning of its brand image launched in 2003.

This had been aimed at highlighting the focus of the

brand on fashion products, to take greater advantage

of the fashion consumer in the sun segment.

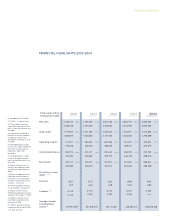

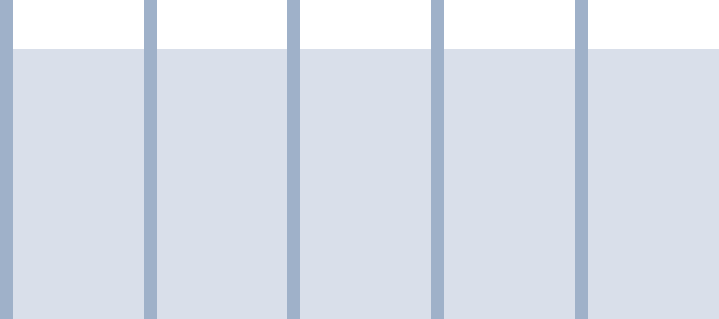

1995

1996

1997 incl. 53rd week

1997 excl. 53rd week

1998

1999

2000

2001

2002

2003 incl. 53rd week

2003 excl. 53rd week

2004

In millions of US$

211.0

233.1

250.7

280.8

324.6

352.1

362.9

516.4

510.8

641.5

First quarter

229.5

233.3

256.7

278.6

323.6

342.9

553.3

553.0

542.7

662.7

Second quarter

228.7

241.1

271.0

298.4

329.9

346.0

530.2

556.4

603.6

668.3

Third quarter

199.7

209.2

261.6

238.4

270.9

299.3

311.1

477.3

479.4

636.2

594.5

945.5

Fourth quarter

869.0

916.7

1,040.0

1,016.8

1,128.7

1,277.4

1,352.1

1,923.7

2,105.2

2,293.3

2,251.7

2,918.1

Full year

SALES OF THE RETAIL DIVISION - 1995-2004