LensCrafters 2004 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

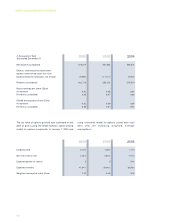

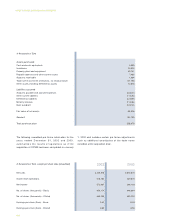

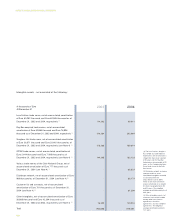

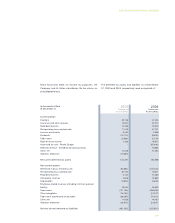

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

117

The Company believes that the preliminary allocation

of the purchase price is reasonable, but it is subject

to revision upon completion of the final valuation of

certain assets and liabilities, which is expected to

occur during the third quarter of 2005. As such, the

purchase price allocation set forth above may

change during 2005 to reflect the final amounts.

Included under the caption “Asset held for sale -

Pearle Europe” in the above table and on the

consolidated balance sheet at December 31, 2004

is the fair value of the Company’s investment in

Pearle Europe B.V. (“PE”) established through

negotiations with the majority shareholder of PE to

acquire the asset. As part of the acquisition of Cole,

the Company acquired approximately 21% of PE’s

outstanding shares. A change of control provision

included in the Articles of Association of PE required

Cole to make an offer to sell these shares to the

shareholders of PE within 30 days of the change of

control, which deadline was extended by agreement

of the parties. In December 2004, substantially all

the terms of the sale were established at a final cash

selling price of Euro 144.0 million, subject to

customary closing conditions. The sale transaction

closed in January 2005 (see Note 15). As the asset

is denominated in Euro, which is not the functional

currency of the subsidiary that held the investment,

the Company has recorded an unrealized foreign

exchange gain of approximately Euro 13.4 million

(US$ 18.2 million) as of December 31, 2004 relating

to the changes in the U.S. Dollar/Euro exchange rate

between October 4, 2004 (the date of the

acquisition) and through December 31, 2004.

The following unaudited proforma information for the

years ended December 31, 2003 and 2004

summarizes the results of operations as if the

acquisition of Cole had been completed on January

1, 2003 and includes certain pro forma adjustments

such as additional amortization expense attributable

to identifiable intangibles.

This pro forma financial information is presented for

information purposes only and is not necessarily

indicative of the results of operations that would have

been achieved had the acquisition taken place on

January 1, 2003.

On October 17, 2004, Cole caused its subsidiary to

purchase Euro 122.2 million (US$ 150 million) of its

outstanding 8 7/8% Senior Subordinated Notes due

2012 in a tender offer and consent solicitation for Euro

143 million (US$ 175.5 million), which amount

represented all of the issued and outstanding notes

of such series. On November 30, 2004, Cole

redeemed all of its outstanding 8 5/8% Senior

Subordinated Notes due 2007 for Euro 103.0 million

(US$ 126.4 million).

Net sales

Income from operations

Net income

No. of shares (thousands) - Basic

No. of shares (thousands) - Diluted

Earnings per share (Euro) - Basic

Earnings per share (Euro) - Diluted

In thousands of Euro, except per share data (Unaudited)

3,901,288

417,598

251,605

448,664

450,202

0.56

0.56

2003

4,027,057

488,223

276,212

448,275

450,361

0.62

0.61

2004