LensCrafters 2004 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

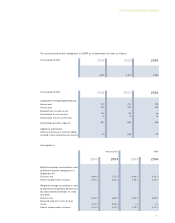

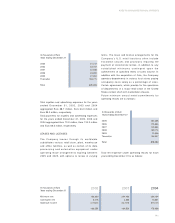

BENEFIT PAYMENTS

The following estimated future benefit payments,

which reflect expected future service, are estimated to

be paid in the years indicated for both the Luxottica

and Cole plans (amounts in thousands of Euro

translated for convenience at the noon buying rate at

December 31, 2004):

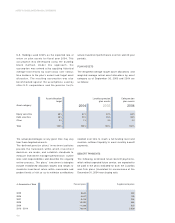

For 2005, a 10.0% (10.5% for 2004) increase in the

cost of covered health care benefits was assumed.

This rate was assumed to decrease gradually to 5%

for 2015 and remain at that level thereafter. The health

care cost trend rate assumption has a significant

effect on the amounts reported. A 1.0% increase or

decrease in the health care trend rate would have an

immaterial impact on the consolidated financial

statements. The weighted average discount rate used

in determining the accumulated post-retirement

benefit obligation was 5.75% at September 30, 2004

and 6.00% at September 30, 2003.

The weighted average discount rate used in

determining the net periodic benefit cost for 2004 and

2003 was 6.0% and 6.5%, respectively.

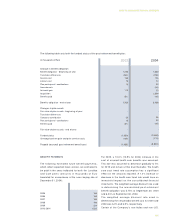

Certain of the Company’s non-Italian and non-U.S.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

135

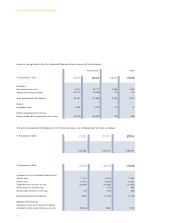

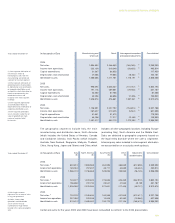

Change in benefit obligation

Benefit obligation - beginning of year

Translation differences

Service cost

Interest cost

Plan participants’ contributions

Amendments

Actuarial gain

Acquisition

Benefits paid

Benefits obligation - end of year

Changes in plan assets

Fair value of plan assets - beginning of year

Translation differences

Company contribution

Plan participants’ contributions

Benefits paid

Fair value of plan assets - end of year

Funded status

Unrecognized net gain and prior service costs

Prepaid (accrued) post-retirement benefit cost

In thousands of Euro

The following table sets forth the funded status of the post-retirement benefit plan:

1,256

(244)

166

75

18

110

(51)

1,330

-

33

18

(51)

-

(1,330)

(160)

(1,490)

2003

1,330

(298)

126

72

23

(94)

(2)

2,359

(48)

3,468

-

25

23

(48)

-

(3,468)

(213)

(3,681)

2004

2005

2006

2007

2008

2009

2010-2014

165

150

185

196

224

1,532