LensCrafters 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

expiration of the credit facility agreement. As of

December 31, 2004, Euro 25 million of the revolving

portion of the loan had been utilized. Luxottica

Group has the option to renew the loan for one, two,

or three month periods until the expiration of the

agreement, at an interest rate defined in the

agreement, or EURIBOR plus 0.55% (2.697% on

December 31, 2004). The financing agreement

contains certain financial and operating covenants

and, as of December 31, 2004, Luxottica Group was

in full compliance with these covenants. This

financing expires on September 30, 2008.

On June 3, 2004, Luxottica Group entered into a

new credit facility agreement with a group of banks

for Euro 740 million and US$ 325 million. This five-

year credit facility is in three tranches (Tranche A,

Tranche B, Tranche C). Tranche A is for Euro 405

million, to be amortized in nine quarterly installments

of Euro 45 million each, beginning in June 2007,

and will be used according to the Group’s needs,

including the refinancing of existing lines of credit

upon expiry. Tranche B is for US$ 325 million in

favor of the Luxottica Group subsidiary U.S.

Holdings, and was used on October 1, 2004 for the

Cole National Corp. acquisition. The Tranche B

loans mature in June 2009. Tranche C consists of a

multi-currency, (Euro/US$), revolving line of credit

for Euro 335 million. Tranche C amounts may be

repaid and re-borrowed until their expiration in June

2009. As of December 31, 2004, US$ 280 million

(Euro 206.8 million) of Tranche C had been utilized

by U.S. Holdings to finance the buying back of all

Cole National bonds issued and not yet repaid.

Luxottica Group may choose one, two, three or six

month interest periods at the EURIBOR for the Euro

portion, and at the LIBOR for the U.S. Dollar portion,

plus a margin of between 0.40% and 0.60%,

calculated as the ratio of Net Financial

Position/EBITDA, as defined in the agreement. The

financing agreement contains certain financial and

operating covenants with which Luxottica Group

was in full compliance as of December 31, 2004.

On December 31, 2004, interest accrued at 2.628%

for Tranche A, 2.456% for Tranche B and 2.889% for

Tranche C. The banks behind these financing

agreements are ABN AMRO, Banca Intesa, Bank of

America, Citigroup, HSBC, Mediobanca, The Royal

Bank of Scotland and UniCredit Banca Mobiliare.

UniCredito Italiano - New York branch - and

UniCredit Banca d’Impresa act as Facility Agents.

As of December 31, 2004, Euro 852 million of this

credit facility had been utilized.

In August 2004, OPSM Group refinanced the

multicurrency loan (A$ and HK$) with Westpac

Banking Corporation for a A$ 100 million line of

credit. Interest on loans in Australian Dollars

accrues at the BBR (Bank Bill Rate), and those in

Hong Kong Dollar, at the HIBOR (HK Interbank

Rate) plus 0.40%. At December 31, 2004, the

interest rate were 5.85% and 0.59%, respectively. At

December 31, 2004, the facility was utulized for an

amount of Euro 11.9 million (A$ 20.7 million). It

expires on August 31, 2006. OPSM Group has the

option to choose weekly or monthly interest

periods. The credit facility contains certain financial

and operating covenants with which, as of

December 31, 2004, OPSM Group was fully

compliant.

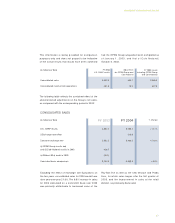

Investments of capital for 2004 were Euro 117.4

million. Of these, Euro 86.0 million in capital

investments were related to the Group’s retail

division, primarily by its headquarters in North

America, and Euro 31.4 million to manufacturing and

wholesale distribution activities, mainly for

improvements to manufacturing facilities and

equipment.

MANAGEMENT’S DISCUSSION AND ANALYSIS