LensCrafters 2004 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

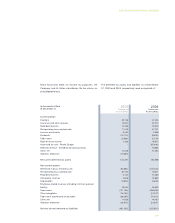

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

132

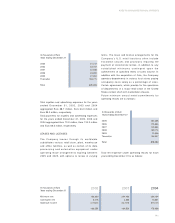

U.S. Holdings used 8.50% as the expected rate of

return on plan assets for fiscal year 2004. This

assumption was developed using the building

block method. Under this approach, the

assumption was arrived at by applying historical

average total returns by asset class over various

time horizons to the plan’s current and target asset

allocation. The resulting assumption was also

benchmarked against the assumptions used by

other U.S. corporations and the pension trust’s

actual investment performance over ten and 20 year

periods.

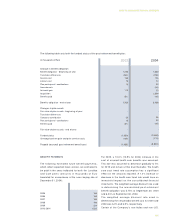

PLAN ASSETS

The weighted-average target asset allocations and

weighted average actual asset allocations by asset

category as of September 30, 2003 and 2004 are

as follows:

The actual percentages at any given time may vary

from these targeted amounts.

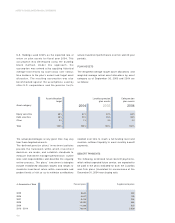

The defined pension plans’ investment policies

provide the framework within which investment

decisions are made, and establish standards to

measure investment manager performance, outline

roles and responsibilities and describe the ongoing

review process. The plans’ investment strategies

include established allocation targets and ranges to

maximize investment return within reasonable and

prudent levels of risk so as to minimize contributions

needed over time to reach a full funding level and

maintain sufficient liquidity to meet monthly benefit

payments.

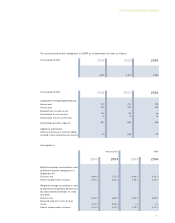

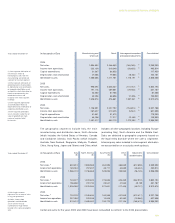

BENEFIT PAYMENTS

The following estimated future benefit payments,

which reflect expected future service, are expected to

be paid in the years indicated for both the Luxottica

and Cole plans (translated for convenience at the

December 31, 2004 noon buying rate):

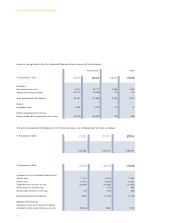

Equity securities

Debt securities

Other

Total

Asset category

64%

35%

1%

100%

2004

65%

35%

0%

100%

62%

35%

3%

100%

2003

65%

33%

2%

100%

2004

Luxottica pension

plan assets

Asset allocation

target Cole pension

plan assets

2005

2006

2007

2008

2009

2010 - 2014

In thousands of Euro

8,644

8,647

9,419

10,392

11,366

78,619

Pension plans

263

153

204

864

323

3,339

Supplemental plans