LensCrafters 2004 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2004 LensCrafters annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

142

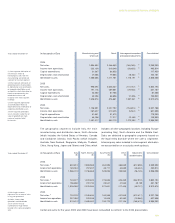

GUARANTEES

The United States Shoe Corporation, a wholly owned

subsidiary of the Company, remains contingently liable

on seven store leases in the United Kingdom. These

leases were previously transferred to third parties. The

third parties have assumed all future obligations of the

leases from the date each agreement was signed.

However, under the common law of the United

Kingdom, the lessor still has the right to seek payment

of certain amounts from the Company if unpaid by the

new obligor. If the Company is required to pay under

these guarantees, it has the right to recover amounts

from the new obligor. These leases will expire during

various years until December 31, 2015. At December

31, 2004, the maximum amount for which the

Company’s subsidiary is contingently liable is Euro

11.6 million.

Cole has guaranteed future minimum lease payments

for certain store locations leased directly by

franchisees. These guarantees aggregated

approximately Euro 8.2 million at December 31, 2004.

Performance under a guarantee by the Company is

triggered by default of a franchisee in its lease

commitment. Generally, these guarantees also extend

to payments of taxes and other expenses payable

under the leases, the amounts of which are not readily

quantifiable. The term of these guarantees ranges

from one to ten years. Many are limited to periods less

than the full term of the lease involved. Under the

terms of the guarantees, Cole has the right to assume

the primary obligation and begin operating the store.

In addition, as part of the franchise agreements, Cole

may recover any amounts paid under the guarantee

from the defaulting franchisee. The Company has

accrued an immaterial liability at December 31, 2004,

relating to these guarantees based on the estimated

fair value, using an expected present value calculation.

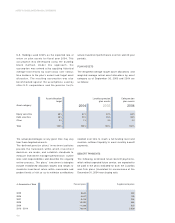

CREDIT FACILITIES

As of December 31, 2003 and 2004 Luxottica Group

had unused short-term lines of credit of approximately

Euro 271.8 million and Euro 365.8 million, respectively.

These lines of credit are renewed annually and are

guaranteed by the Company. At December 31, 2004,

there were Euro 5.2 million of borrowings outstanding

and Euro 29.0 million in aggregate face amount of

standby letters of credit outstanding under these lines

of credit (see below).

The blended average interest rate on these lines of

credit is approximately LIBOR plus 0.25%.

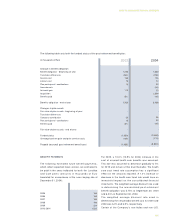

OUTSTANDING STANDBY LETTERS OF CREDIT

A U.S. subsidiary has obtained various standby letters

of credit from banks that aggregate Euro 21.2 million

and Euro 35.6 million as of December 31, 2003 and

2004, respectively. Most of these letters of credit are

used for security in risk management contracts or as

security on store leases. Most contain evergreen

clauses under which the letter is automatically

renewed unless the bank is notified not to renew.

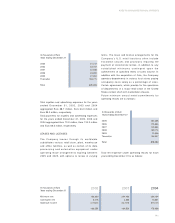

LITIGATION

In May 2001, certain former shareholders of Sunglass

Hut International, Inc. commenced an action in the

U.S. District Court for the Eastern District of New York

against the Company, its acquisition subsidiary

formed to acquire SGHI and certain other

defendants, on behalf of a purported class of former

SGHI stockholders, alleging in the original and in the

amended complaint filed later, among other claims,

that the defendants violated certain provisions of U.S.

securities laws and the rules thereunder, in

connection with the acquisition of SGHI in a Tender

Offer and second-step merger, by reason of entering

into a consulting, non-disclosure and non-

competition agreement prior to the commencement

of the Tender Offer, with the former chairman of SGHI,

which purportedly involved paying consideration to

such person for his SGHI shares and his support of

the Tender Offer that was higher than that paid to

SGHI’s stockholders in the Tender Offer. The plaintiffs

are seeking, among other remedies, the payment of