Kia 2015 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

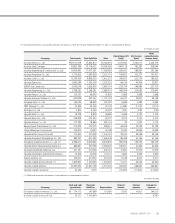

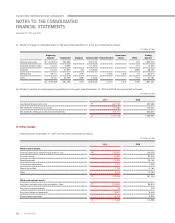

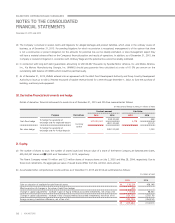

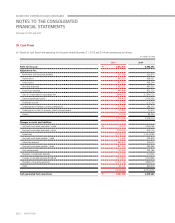

(g) Sensitivity analysis of defined obligations from changes of assumptions for the years ended December 31, 2015 and 2014 are summarized as

follows:

(In millions of won)

2015 2014

1% Up 1% Down 1% Up 1% Down

Discount rate

₩

(228,321) 272,550 (198,981) 273,812

Rate of salary growth 271,240 (231,499) 139,455 (123,965)

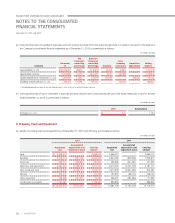

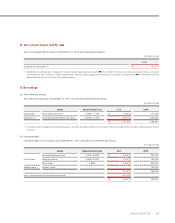

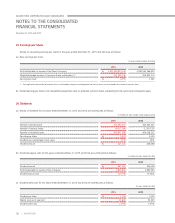

18. Provisions

The Company provides general warranty to the ultimate consumer for each product sold and accrues warranty expense at the time of sale

based on the history of actual claims. Also, the Company accrues potential expenses, which may occur due to replacement of parts or

voluntary recalls pending as of the end of the reporting period.

Other provision are comprised of provision related to loss on lawsuits.

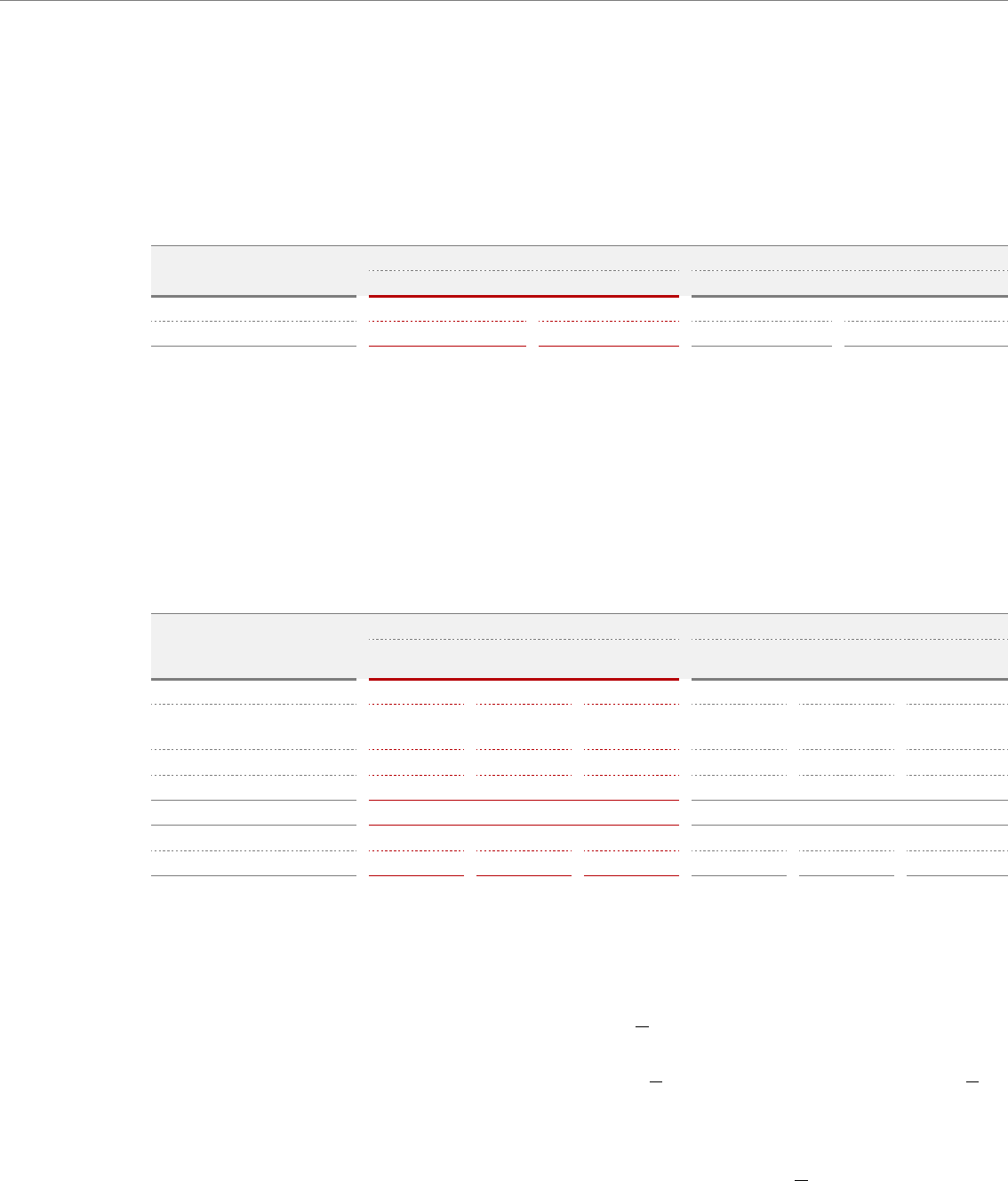

Changes in provisions for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Provision of

warranty for sale Other provision Total

Provision of

warranty for sale Other provision Total

Balance at January 1 ₩

2,037,303 16,067 2,053,370 2,011,256 29,537 2,040,793

Provisions made (reimbursed)

during the year

1,365,271 18 1,365,289 997,232 (636) 996,596

Provisions used during the year

(1,025,118) (2,958) (1,028,076) (898,615) (19,106) (917,721)

Other increase (decrease) (*)

(10,794) 10,373 (421) (72,570) 6,272 (66,298)

Balance at December 31 ₩

2,366,662 23,500 2,390,162 2,037,303 16,067 2,053,370

Thereof current

677,559 20,933 698,492 654,950 12,704 667,654

Thereof non-current ₩

1,689,103 2,567 1,691,670 1,382,353 3,363 1,385,716

(*) Other increase (decrease) is mainly related to foreign currency translation impact

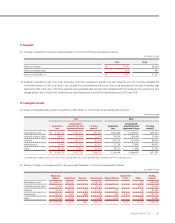

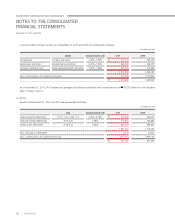

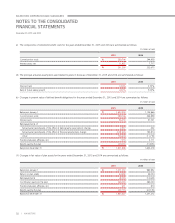

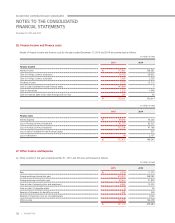

19. Commitments and Contingencies

(a) The Company provides guarantees for certain customers’ financing relating to long-term installment sales. The oustanding amount for which

the Company has provided guarantees to the respective financial institutions is W 1,552 million as of December 31, 2015. These guarantees

are covered by insurance contracts in which the Company is the beneficiary of the claim amount if the customer defaults.

(b) As of December 31, 2015, the Company has pledged one certificate deposit of W 1,454 million and 1,500 units(carrying amount: W 629

million) of equity investments in the Korea Defense Industry Association(“KDIA”), which are included in long-term available-for-sale financial

assets, as collaterals to Korea Defense Industry Association(“KDIA”).

(c) The Company provides guarantees for employees relating to borrowings to acquire shares of the Parent Company. The outstanding amount

for which the Company has provided collective guarantees to the Korea Securities Finance Corporation is W 293,444 million as of December

31, 2015. Management is of the opinion that afore mentioned guarantees will not have a material adverse effect on the Company’s credit

risk since the Company has pledged its acquired shares as collateral for the borrowings.

93

ANNUAL REPORT 2015 |