Kia 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

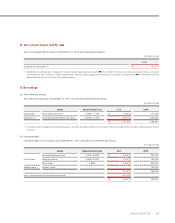

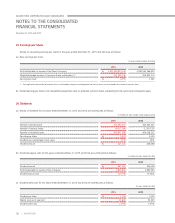

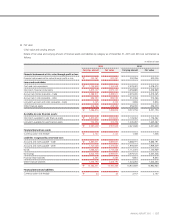

(b) Other expense for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Foreign exchange transaction loss

₩

436,480 284,582

Foreign exchange translation loss 96,128 253,136

Loss on disposal of accounts and notes receivable - trade 518 686

Donation 28,399 26,224

Loss on sale of property, plant and equipment 31,220 41,995

Loss on sale of intangible assets 16 138

Impairment loss of intangible assets 3,341 1,337

Impairment loss on non-current assets held for sale 175,746 -

Other expenses 117,797 83,440

₩

889,645 691,538

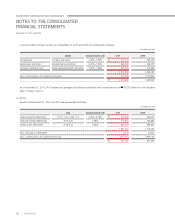

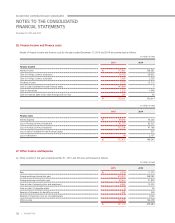

28. Income Tax Expense

(a) The component of income tax expense for the years ended December 31, 2015 and 2014 are as follows:

(In millions of won)

2015 2014

Current tax expense

₩

709,076 725,166

Origination and reversal of temporary differences (343,315) 60,471

Income tax recognized in other comprehensive income 103,905 37,086

Total income tax expense

₩

469,666 822,723

(b) Income tax benefit recognized directly in other equity and other comprehensive income for the years ended December 31, 2015 and 2014

are as follows:

(In millions of won)

2015 2014

Current tax:

Defined benefit plan remeasurements

₩

19 51,757

Deferred income tax:

Loss (gain) on valuation of available-for-sale financial assets 104,023 (14,671)

Effective portion of changes in fair value of cash flow hedges (137) -

103,886 (14,671)

Income tax recognized directly in other comprehensive income

₩

103,905 37,086

Income tax related to defined benefit plan remeasurements, gains/losses on valuation of available-for-sale financial assets and gains/losses on

valuation of derivative instruments were recognized in other comprehensive income.

99

ANNUAL REPORT 2015 |