Kia 2015 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

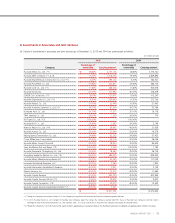

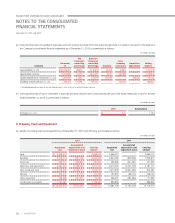

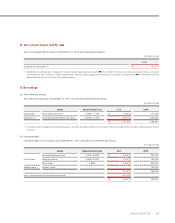

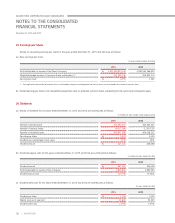

14. Non-current Assets Held for Sale

Non-current assets held for sale as of December 31, 2015 are summarized as follows:

(In millions of won)

2015

Investment in associates (*)

₩

161,274

(*) According to the Company’s plans to dispose of its shares of Hyundai Steel Company amounted to W 337,020 million in the future, the Company classified the shares as non-current

assets held for sale from investments in associates during the year. Also, the Company recognized impairment loss on non-current assets held for sale of W 175,746 million which is the

difference between fair value less costs to sell and carrying amount.

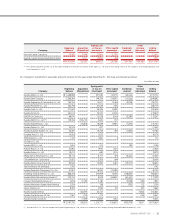

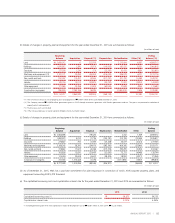

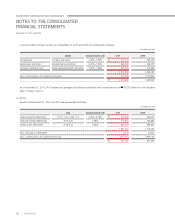

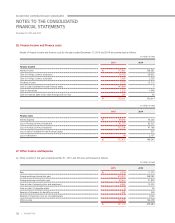

15. Borrowings

(a) Short-term borrowings

Short-term borrowings as of December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

Lender Annual interest rate 2015 2014

Usance bills Woori Bank and others 0.36%~1.11%

₩

103,646 117,158

Trade bills (*) Korea Development Bank and others 0.003%~2.45% 1,408,778 1,272,675

₩

1,512,424 1,389,833

(*) The Company did not derecognize outstanding trade accounts and notes receivable transferred to the financial institutions and recognized the transactions as borrowings from financial

institutions.

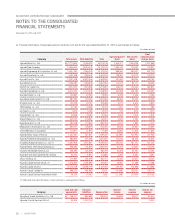

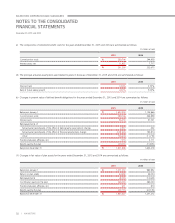

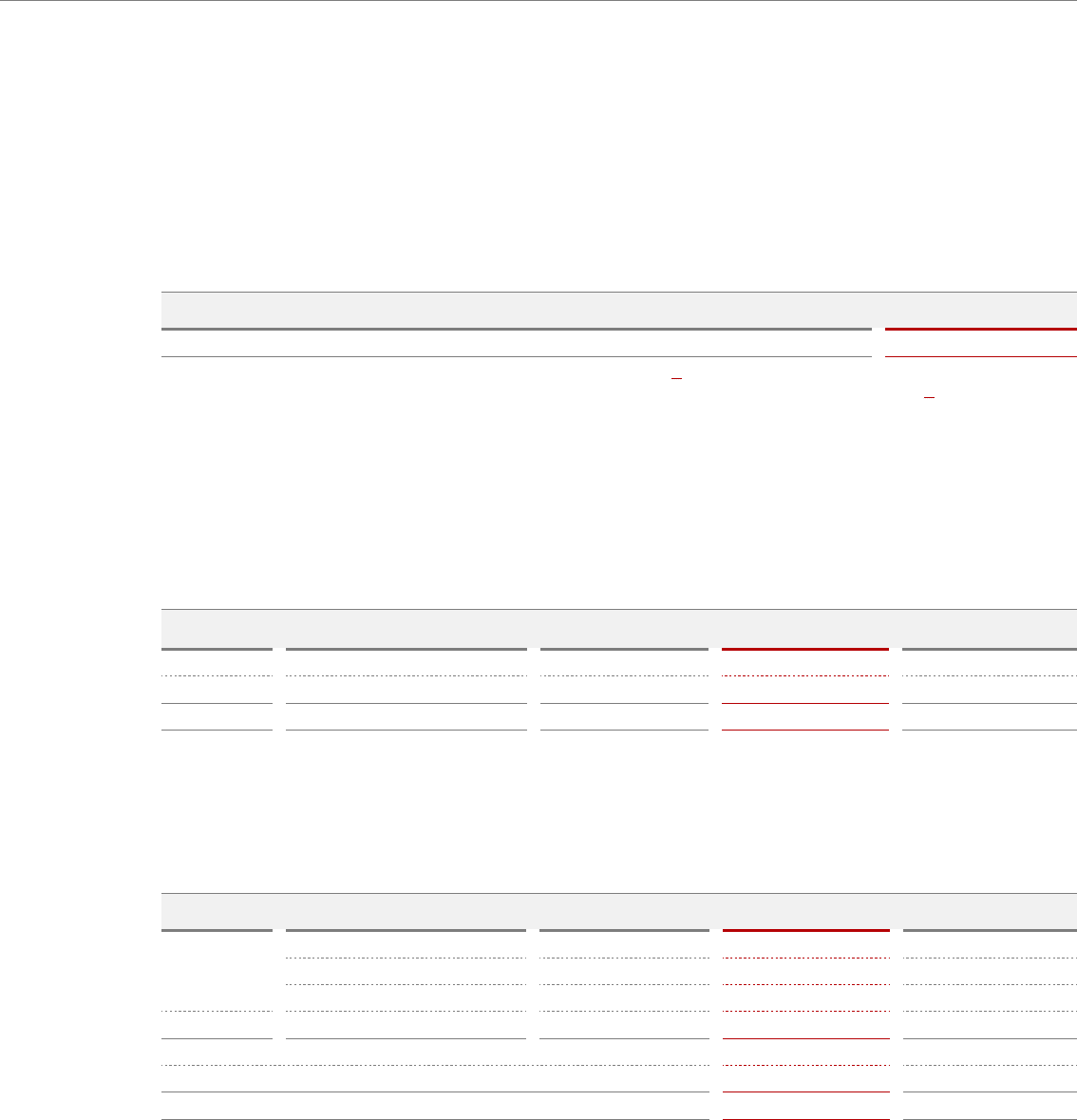

(b) Long-term debt

Long-term debt in local currency as of December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

Lender Annual interest rate 2015 2014

Facility loans

Korea Development Bank 2.47%~2.83%

₩

360,000 230,000

Nong Hyup Bank 2.40%~3.50% 250,000 180,000

Woori Bank 2.48% 200,000 200,000

General loans Kookmin Bank - -150,000

810,000 760,000

Less : current portion of long-term borrowings (410,000) -

₩

400,000 760,000

89

ANNUAL REPORT 2015 |