Kia 2015 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

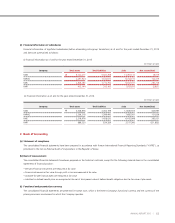

In addition, employees of KMA are eligible to participate, upon meeting certain service requirement, in the profit sharing retirement plan and

defined benefit pension plan under the Internal Revenue Code 401(k) in the United States. KMA and employees of KMA paid each contributions

during the period in which the employees render the related service.

(s) Provisions

Provisions are recognized when the Company has a present legal or constructive obligation as a result of a past event, it is probable that an

outflow of resources embodying economic benefits will be required to settle the obligation and a reliable estimate can be made of the amount

of the obligation.

The risks and uncertainties that inevitably surround many events and circumstances are taken into account in reaching the best estimate of a

provision. Where the effect of the time value of money is material, provisions are determined at the present value of the expected future cash

flows.

Where some or all of the expenditures required to settle a provision are expected to be reimbursed by another party, the reimbursement shall be

recognized when, and only when, it is virtually certain that reimbursement will be received if the entity settles the obligation. The reimbursement

is treated as a separate asset.

Provisions are reviewed at the end of each reporting period and adjusted to reflect the current best estimates. If it is no longer probable that an

outflow of resources embodying economic benefits will be required to settle the obligation, the provision is reversed.

A provision for warranties is recognized when the underlying products or services are sold. The provision is based on historical warranty data and

a weighting of all possible outcomes against their associated probabilities.

A provision shall be used only for expenditures for which the provision was originally recognized.

(t) Emission Rights

The Company accounts for greenhouse gases emission right and the relevant liability as below pursuant to the Act on Allocation and Trading of

Greenhouse Gas Emission which became effective in 2015.

① Greenhouse Gases Emission Right

Greenhouse Gases Emission Right consists of emission allowances which are allocated from the government free of charge or purchased from the

market. The cost includes any cost directly attributable to bringing the asset and condition necessary for it to be capable of operating in the manner

intended by management.

Emission Rights held for the purpose of performing the obligation is classified as intangible asset. The intangible asset is initially measured at cost and

after initial recognition, are carried at cost less accumulated impairment losses.

The Company derecognizes an emission right asset when the emission allowance is unusable, disposed or submitted to government in which the

future economic benefits are no longer expected to be probable.

② Emission liability

Emission liability is a present obligation of submitting emission rights to the government with regard to emission of greenhouse gas. Emission liability is

recognized when it is probable that outflows of resources will be required to settle the obligation and the costs required to perform the obligation are

reliably estimable. Emission liability is an amount of estimated obligations for emission rights to be submitted to the government for the performing

period. The emission liability is measured based on the expected quantity of emission for the performing period in excess of emission allowance in

possession and the unit price for such emission rights in the market at the end of the reporting period.

73

ANNUAL REPORT 2015 |