Kia 2015 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

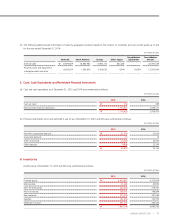

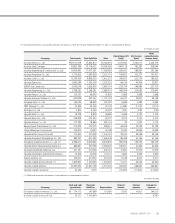

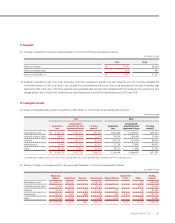

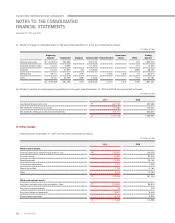

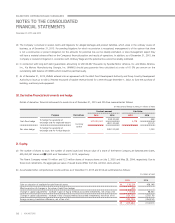

11. Goodwill

(a) Changes in goodwill for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Balance at January 1

₩

37,231 36,290

Other increase(decrease) (196) 941

Balance at December 31

₩

37,035 37,231

(b) Goodwill is allocated to each CGU (Cash Generating Unit) that is expected to benefit from each operating unit. The Company estimated the

recoverable amount of CGU as its value in use calculated by discounting the future cash flows to be generated on the basis of business plan

approved by CEO in five years. Cash flows expected to be generated after five years were estimated within the scope of not to exceed long term

average growth rate of industry. No impairment loss was recognized as a result of the impairment tests in 2015 and 2014.

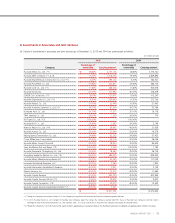

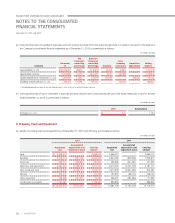

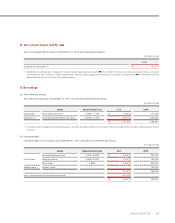

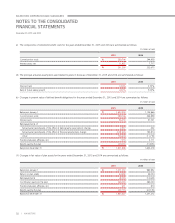

12. Intangible Assets

(a) Details of intangible assets except for goodwill as of December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Acquisition

cost

Accumulated

amortization and

impairment losses

Carrying

amount

Acquisition

cost

Accumulated

amortization and

impairment losses

Carrying

amount

Development costs

₩

3,536,145 (1,640,337) 1,895,808 2,870,484 (1,220,961) 1,649,523

Industrial property rights 84,614 (71,340) 13,274 76,554 (62,646) 13,908

Software 271,122 (187,553) 83,569 241,723 (155,633) 86,090

Membership (*) 74,449 (11,131) 63,318 72,758 (7,843) 64,915

Other 43,198 (2,417) 40,781 38,525 (1,364) 37,161

₩

4,009,528 (1,912,778) 2,096,750 3,300,044 (1,448,447) 1,851,597

(*) Membership has indefinite useful lives and it has been tested for impairment annually by comparing its recoverable amount to its carrying amount.

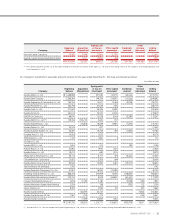

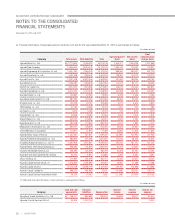

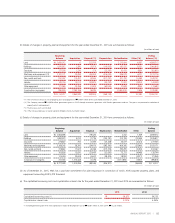

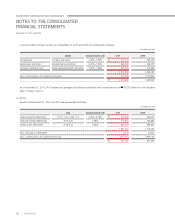

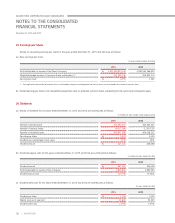

(b) Details of changes in intangible assets for the year ended December 31, 2015 are summarized as follows:

(In millions of won)

Beginning

balance Acquisition Disposal Amortization Reclassification

Impairment

losses Other

Ending

balance

Development costs

₩

1,649,523 663,783 - (418,230) - - 732 1,895,808

Industrial property rights 13,908 4,550 - (2,227) - - (2,957) 13,274

Software 86,090 28,524 (17) (31,545) 418 - 99 83,569

Membership 64,915 2,687 (848) (19) (68) (3,341) (8) 63,318

Other 37,161 5,039 - (1,189) (350) - 120 40,781

₩

1,851,597 704,583 (865) (453,210) - (3,341) (2,014) 2,096,750

87

ANNUAL REPORT 2015 |