Kia 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

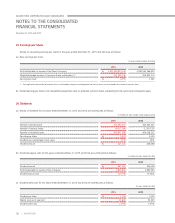

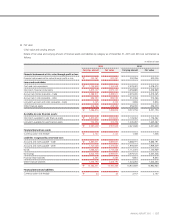

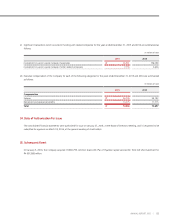

(ii) Aggregate maturities of the Company’s financial liabilities, including estimated interest, as of December 31, 2014 are summarized as follows:

(In millions of won)

Within 1 year 1~5 years Over 5 years Total

Accounts and notes payable – trade

₩

5,888,191 - - 5,888,191

Accounts and notes payable - other 1,959,339 - - 1,959,339

Accrued expenses 1,359,185 - - 1,359,185

Bonds 337,880 832,017 - 1,169,897

Borrowings 1,564,586 2,024,040 114,760 3,703,386

Financial lease liabilities 5,598 4,665 - 10,263

Other current liabilities 4,516 - - 4,516

Other non-current liabilities - 63,575 - 63,575

₩

11,119,295 2,924,297 114,760 14,158,352

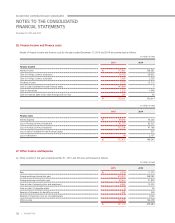

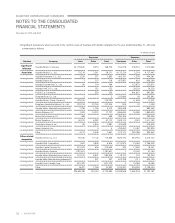

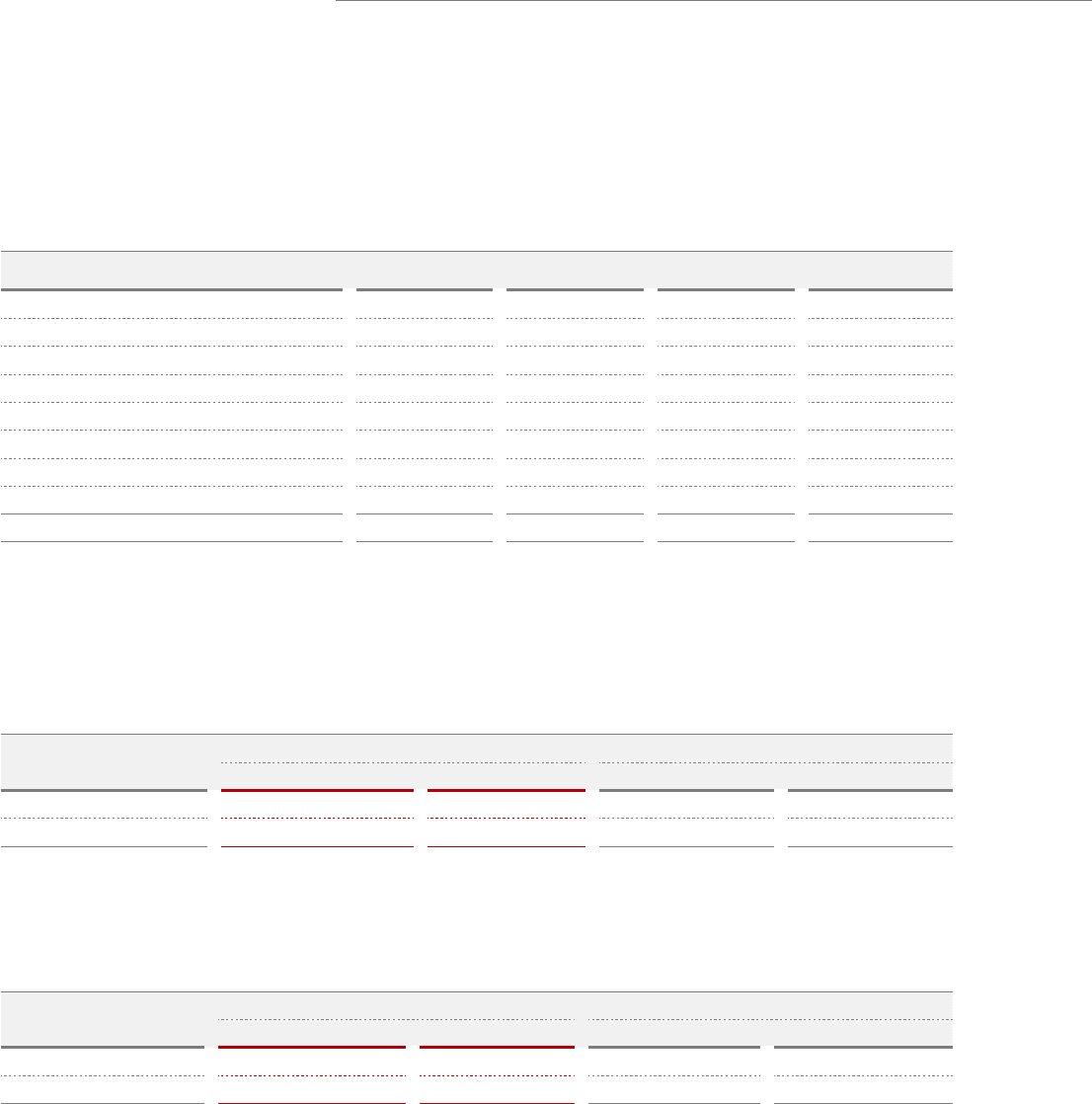

(c) Foreign exchange risk

The Company’s capital and income (loss) would have been increased or decreased, if the foreign exchange rate against USD and EUR were

higher. The Company assumes that interest rate fluctuates 10% at year ended period. Also, the Company assumes that others variables such as

interest rate are not changed by sensitive analysis. The Company analyzed by the same method as used for last period and details for the effect

on income before taxes are summarized as follows:

(In millions of won)

2015 2014

10% Up 10% Down 10% Up 10% Down

USD

₩

(236,585) 236,585 (186,042) 186,042

EUR (17,671) 17,671 (14,403) 14,403

(d) Interest rate risk

Sensitivity analysis of interest expenses and interests income from changes of interests rate for the years ended December 31, 2015 and 2014

are as summarized as follows:

(In millions of won)

2015 2014

100 bps Up 100 bps Down 100 bps Up 100 bps Down

Interest income

₩

13,049 (13,049) 24,785 (24,785)

Interest expense 23,206 (23,206) 12,900 (12,900)

106 | KIA MOTORS

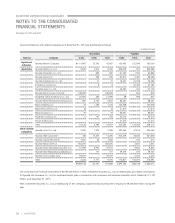

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS