Kia 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

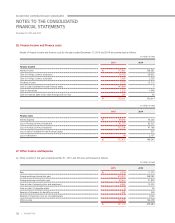

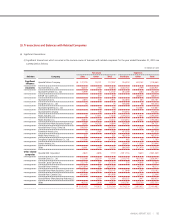

The Company measured the fair value of financial instruments as follows:

•Thefairvalueofavailable-for-salenancialassetstradedwithinthemarketismeasuredattheclosingbidpricequotedattheendofthe

reporting period.

•Thefairvalueofthederivativesisthepresentvalueofthedifferencebetweencontractualforwardpriceandfutureforwardpricediscounted

during the remaining period of the contract, from present to contractual maturity.

Except for the financial assets and liabilities above, the fair value of current receivables is close to their carrying amounts. In addition, the fair

value of other financial instruments is determined as the present value of estimated future cash flows discounted at the current market interest

rate. As of December 31, 2015, there isn’t any significant business climate and economic environment changes affecting the fair value of

financial assets and liabilities.

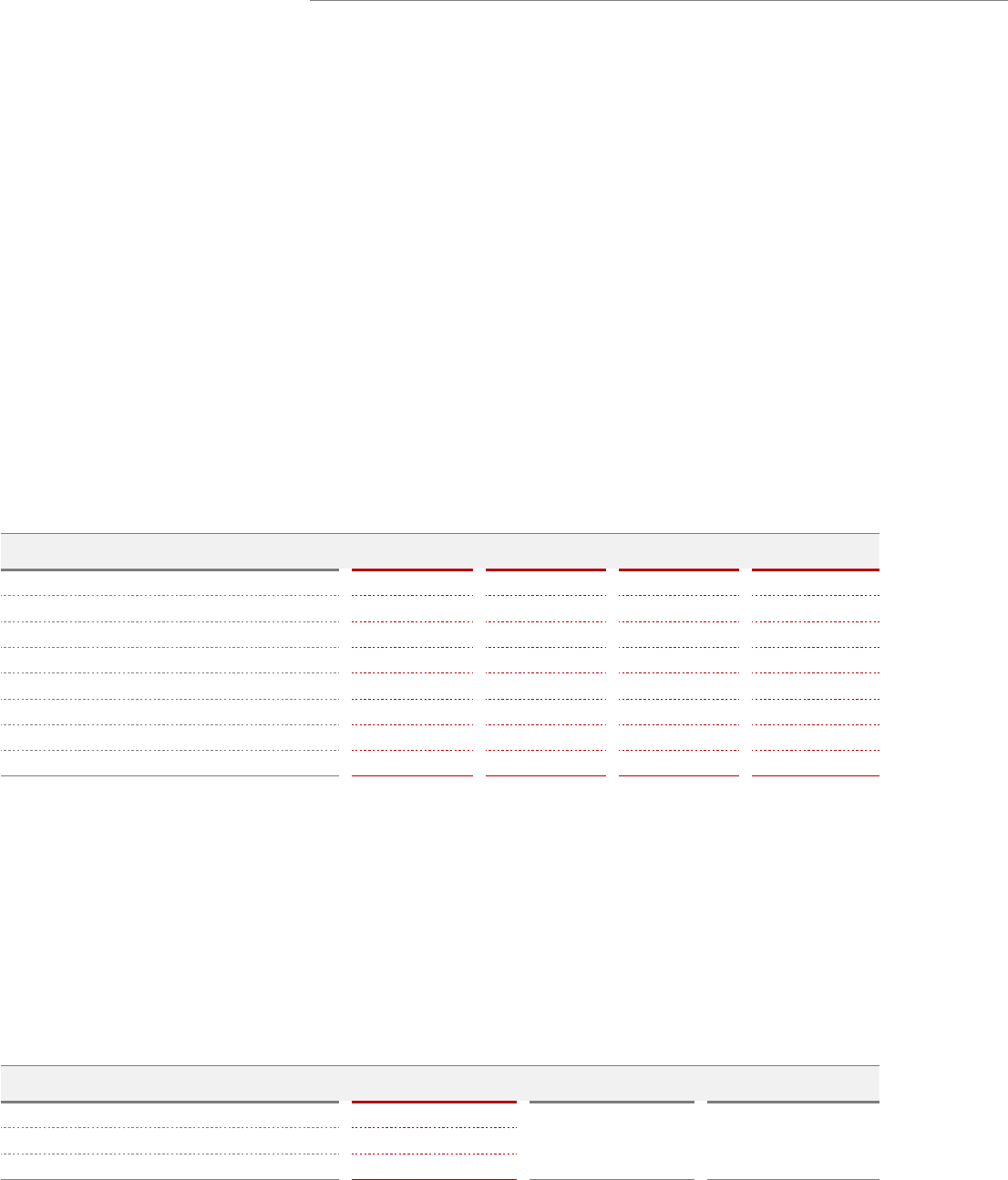

(ii) Fair value hierarchy

Fair value measurement classified by fair value hierarchy as of December 31, 2015 are summarized as follows:

(In millions of won)

Level 1 Level 2 Level 3 Total

Financial asset at fair value through profit or loss:

Financial asset at fair value through profit or loss

₩

- 200,261 - 200,261

Available-for-sale financial assets:

Marketable securities 423,681 - - 423,681

Financial derivatives assets:

Currency option (risk hedge) - 2,122 - 2,122

Financial derivatives liabilities:

Currency option (risk hedge) - 44 - 44

There were no significant transfers between levels 1, 2, and 3.

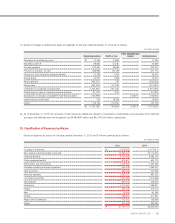

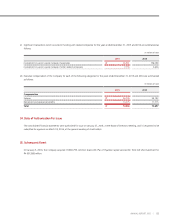

When measuring the fair value of an asset or a liability, the Company uses market observable data as far as possible. Fair values are categorized

into different levels in a fair value hierarchy based on the inputs used in the valuation techniques as follows.

Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly (i.e. as prices) or indirectly

(i.e. derived from prices).

Level 3: inputs for the asset or liability that are not based on observable market data (unobservable inputs).

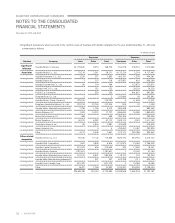

The valuation techniques and the unobservable inputs used in measuring Level 2 fair values as of December 31, 2015 are summarized as follows:

(In millions of won)

Fair value Valuation methods Inputs

Financial assets at fair value through profit or loss

₩

200,261

DCF model Discount rate (*)

Hedging derivative financial assets 2,122

Hedging derivative financial liabilities 44

(*) The expected net cash flows are discounted using a risk-adjusted discount rate based on government bonds

108 | KIA MOTORS

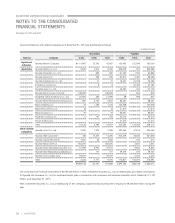

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS