Kia 2015 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

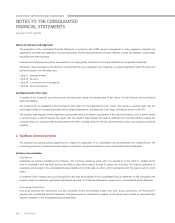

(d) Use of estimates and judgments

The preparation of the consolidated financial statements in conformity with K-IFRS requires management to make judgments, estimates and

assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results

may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized prospectively.

Information about assumptions and estimation uncertainties that have a significant risk of resulting in a material adjustment within the next fiscal

year are included in the following notes:

•Note17:EmployeeBenets

•Note18:Provisions

•Note19:CommitmentsandContingencies

•Note28:IncomeTaxExpense

(e) Measurement of fair value

A number of the Company’s accounting policies and disclosures require the measurement of fair values, for both financial and non-financial

assets and liabilities.

The Company has an established control framework with respect to the measurement of fair values. This includes a valuation team that has

overall responsibility for overseeing all significant fair value measurements, including Level 3 fair values, and reports directly to the CFO.

The valuation team regularly reviews significant unobservable inputs and valuation adjustments. If third party information, such as broker quotes

or pricing services, is used to measure fair values, then the valuation team assesses the evidence obtained from the third parties to support the

conclusion that such valuations meet the requirements of K-IFRS, including the level in the fair value hierarchy in which such valuations should be

classified.

3. Significant Accounting Policies

The significant accounting policies applied by the Company in preparation of its consolidated financial statements are included below. The

accounting policies set out below have been applied consistently to all periods presented in these consolidated financial statements.

(a) Basis of consolidation

Subsidiaries

Subsidiaries are entities controlled by the Company. The Company controls an entity when it is exposed to, or has rights to, variable returns

from its involvement with the entity and has the ability to affect those returns through its power over the entity. The financial statements of

subsidiaries are included in the consolidated financial statements from the date on which control commences until the date on which control

ceases.

If a member of the Company uses accounting policies other than those adopted in the consolidated financial statements for like transactions and

events in similar circumstances, appropriate adjustments are made to its financial statements in preparing the consolidated financial statements.

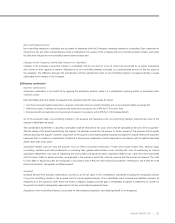

Intra-group transactions

Intra-group balances and transactions, and any unrealized income and expenses arising from intra- group transactions, are eliminated in

preparing the consolidated financial statements. Intra-group losses are recognized as expense if intra-group losses indicate an impairment that

requires recognition in the consolidated financial statements.

64 | KIA MOTORS

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS