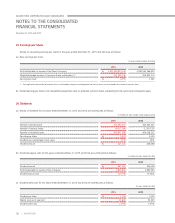

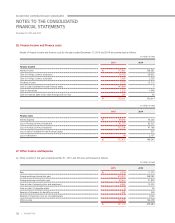

Kia 2015 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

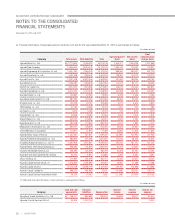

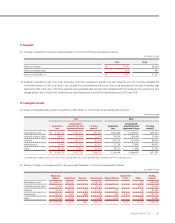

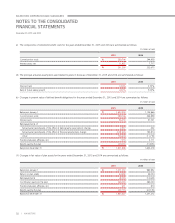

(c) The components of retirement benefit costs for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Current service costs

₩

289,706 244,958

Interest costs, net 11,687 7,717

₩

301,393 252,675

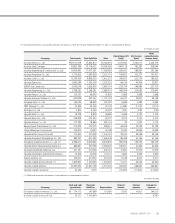

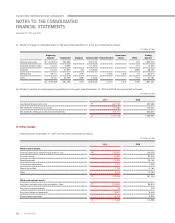

(d) The principal actuarial assumptions used related to plans in Korea as of December 31, 2015 and 2014 are summarized as follows:

2015 2014

Discount rate 3.04% 3.53%

Rate of future salary growth 4.00% 5.00%

(e) Changes in present value of defined benefit obligations for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Balance at January 1

₩

1,603,218 1,154,866

Current service costs 289,706 244,958

Interest costs 56,350 51,721

Remeasurements of:

Net actuarial gains(losses) of the effect of demographic assumptions change 2,517 402

Net actuarial gains(losses) of the effect of financial assumptions change (109,163) 192,814

Other 100,434 (11,719)

Transfers between affiliates, net (171) 2,111

Benefit paid by the plan (41,023) (31,935)

Balance at December 31

₩

1,901,868 1,603,218

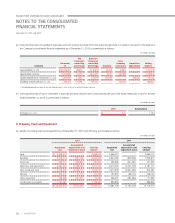

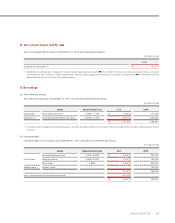

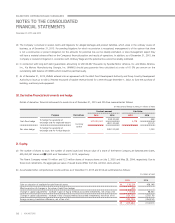

( f ) Changes in fair value of plan assets for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Balance at January 1

₩

1,271,212 982,952

Return on plan assets 44,663 44,004

Remeasurements (8,042) (14,424)

Contribution paid into the plan 360,000 280,000

Transfers between affiliates, net 411 810

Benefit paid by the plan (22,717) (22,130)

Balance at December 31

₩

1,645,527 1,271,212

92 | KIA MOTORS

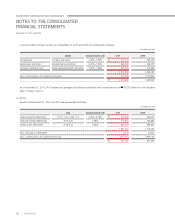

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS