Kia 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

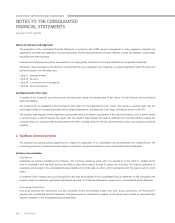

(c) Associates and joint ventures

An associate is an entity in which the Company has significant influence, but not control, over the entity’s financial and operating policies.

Significant influence is presumed to exist when the Company holds between 20 and 50 percent of the voting power of another entity.

Joint ventures are those entities over whose activities the Company has joint control, established by contractual agreement, and require

unanimous consent for strategic financial and operating decisions.

The investment in an associate and joint venture is initially recognized at cost and the carrying amount is increased or decreased to recognize the

Company’s share of the profit or loss and changes in equity of the associate and joint venture after the date of acquisition. Intra-group balances

and transactions, and any unrealized income and expenses arising from intra-group transactions, are eliminated in preparing the consolidated

financial statements. Intra-group losses recognized as expense if intra-group losses indicate an impairment that requires recognition in the

consolidated financial statements.

If an associate and joint venture uses accounting policies different from those of the Company for like transactions and events in similar

circumstances, appropriate adjustments are made to its financial statements in applying the equity method.

When the Company’s share of losses exceeds its interest in an equity accounted investee, the carrying amount of that interest, including any

long-term investments, is reduced to nil and the recognition of further losses is discontinued except to the extent that the Company has an

obligation or has to make payments on behalf of the investee for further losses.

(d) Cash and cash equivalents

Cash and cash equivalents comprised of cash on hand, demand deposits and short-term, highly liquid investments that are readily convertible to

known amounts of cash and which are subject to an insignificant risk of changes in value.

(e) Inventories

Inventories are measured at the lower of cost or net realizable value. The cost of inventories is determined based on the specific identification

method for materials-in-transit and moving-average method for all other inventories, and includes expenditure incurred in acquiring the

inventories, production or conversion costs and other costs incurred in bringing them to their existing location and condition.

When inventories are sold, the carrying amount of those inventories is recognized as cost of goods sold in same period as the related revenue.

Net realizable value is the estimated selling price in the ordinary course of business, less the estimated costs of completion and selling expenses.

The amount of any write-down of inventories to net realizable value and all losses of inventories are recognized as an expense in the period the

write-down or loss occurs. The amount of any reversal of any write-down of inventories, arising from an increase in net realizable value, are

recognized as a reduction in the amount of inventories recognized as an expense in the period in which the reversal occurs.

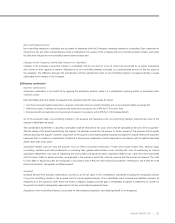

(f) Non-current assets held for sale

Non-current assets or disposal groups comprising assets and liabilities that are expected to be recovered primarily through sale rather than

through continuing use are classified as held for sale. In order to be classified as held for sale, the assets or disposal groups must be available for

immediate sale in their present condition and their sale must be highly probable. The assets or disposal groups that are classified as non-current

assets held for sale are measured at the lower of their carrying amount and fair value less cost to sell. The Company recognizes an impairment

loss for any initial or subsequent write-down of an asset or disposal group to fair value less costs to sell, and a gain for any subsequent increase

in fair value less costs to sell, up to the cumulative impairment loss previously recognized.

A non-current asset that is classified as held for sale or part of a disposal group classified as held for sale is not depreciated (or amortized).

66 | KIA MOTORS

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS