Kia 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The depreciable amount of a leased asset is allocated to each accounting period during the period of expected use on a systematic basis consistent

with the depreciation policy the lessee adopts for depreciable assets that are owned. If there is no reasonable certainty that the lessee will obtain

ownership by the end of the lease term, the asset is fully depreciated over the shorter of the lease term and its useful life. The Company reviews to

determine whether the leased asset may be impaired.

(q) Government grants

Government grants are not recognized unless there is reasonable assurance that the Company will comply with the grant’s conditions and that the

grant will be received. Government grants whose primary condition is that the Company purchase, construct or otherwise acquire long-term assets

are deducted in calculating the carrying amount of the asset. The grant is recognized in profit or loss over the life of a depreciable asset as a reduction

to depreciation expense.

Other government grants which are intended to compensate the Company for expenses incurred are deducted from related costs over the periods

in which the Company recognizes the related costs as expenses. Government grants which are intended to give immediate financial support to the

Company with no future related costs are recognized as government grant income in profit or loss.

(r) Employee benefits

Short-term employee benefits

Short-term employee benefits are employee benefits that are due to be settled within 12 months after the end of the period in which the employees

render the related service. When an employee has rendered service to the Company during an accounting period, the Company recognizes the

undiscounted amount of short-term employee benefits expected to be paid in exchange for that service.

Other long-term employee benefits

Other long-term employee benefits include employee benefits that are settled beyond 12 months after the end of the period in which the employees

render the related service, and are calculated at the present value of the amount of future benefit that employees have earned in return for their

service in the current and prior periods, less the fair value of any related assets. The present value is determined by discounting the expected future

cash flows using the interest rate of high-quality corporate bonds that have maturity dates approximating the terms of the Company’s obligations and

that are denominated in the same currency in which the benefits are expected to be paid. Any actuarial gains and losses are recognized in profit or

loss in the period in which they arise.

Retirement benefits: defined benefit plans

The Company’s net obligation in respect of defined benefit plans is calculated separately for each plan by estimating the amount of future benefit that

employees have earned in the current and prior periods, discounting that amount and deducting the fair value of any plan assets.

The calculation of defined benefit obligations is performed annually by a qualified actuary using the projected unit credit method. When the

calculation results in a potential asset for the Company, the recognized asset is limited to the present value of economic benefits available in the

form of any future refunds from the plan or reductions in future contributions to the plan. To calculate the present value of economic benefits,

consideration is given to any applicable minimum funding requirements.

Remeasurements of the net defined benefit liability, which comprise actuarial gains and losses, the return on plan assets (excluding interest) and

the effect of the asset ceiling (if any, excluding interest), are recognized immediately in OCI. The Company determines the net interest expense

(income) on the net defined benefit liability (asset) for the period by applying the discount rate used to measure the defined benefit obligation

at the beginning of the annual period to the then-net defined benefit liability (asset), taking into account any changes in the net defined benefit

liability (asset) during the period as a result of contributions and benefit payments. Net interest expense and other expenses related to defined

benefit plans are recognized in profit or loss.

When the benefits of a plan are changed or when a plan is curtailed, the resulting change in benefit that relates to past service or the gain or

loss on curtailment is recognized immediately in profit or loss. The Company recognizes gains and losses on the settlement of a defined benefit

plan when the settlement occurs.

72 | KIA MOTORS

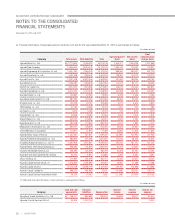

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS