Kia 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

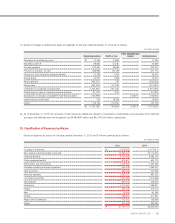

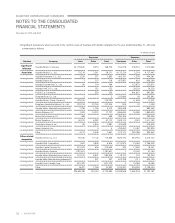

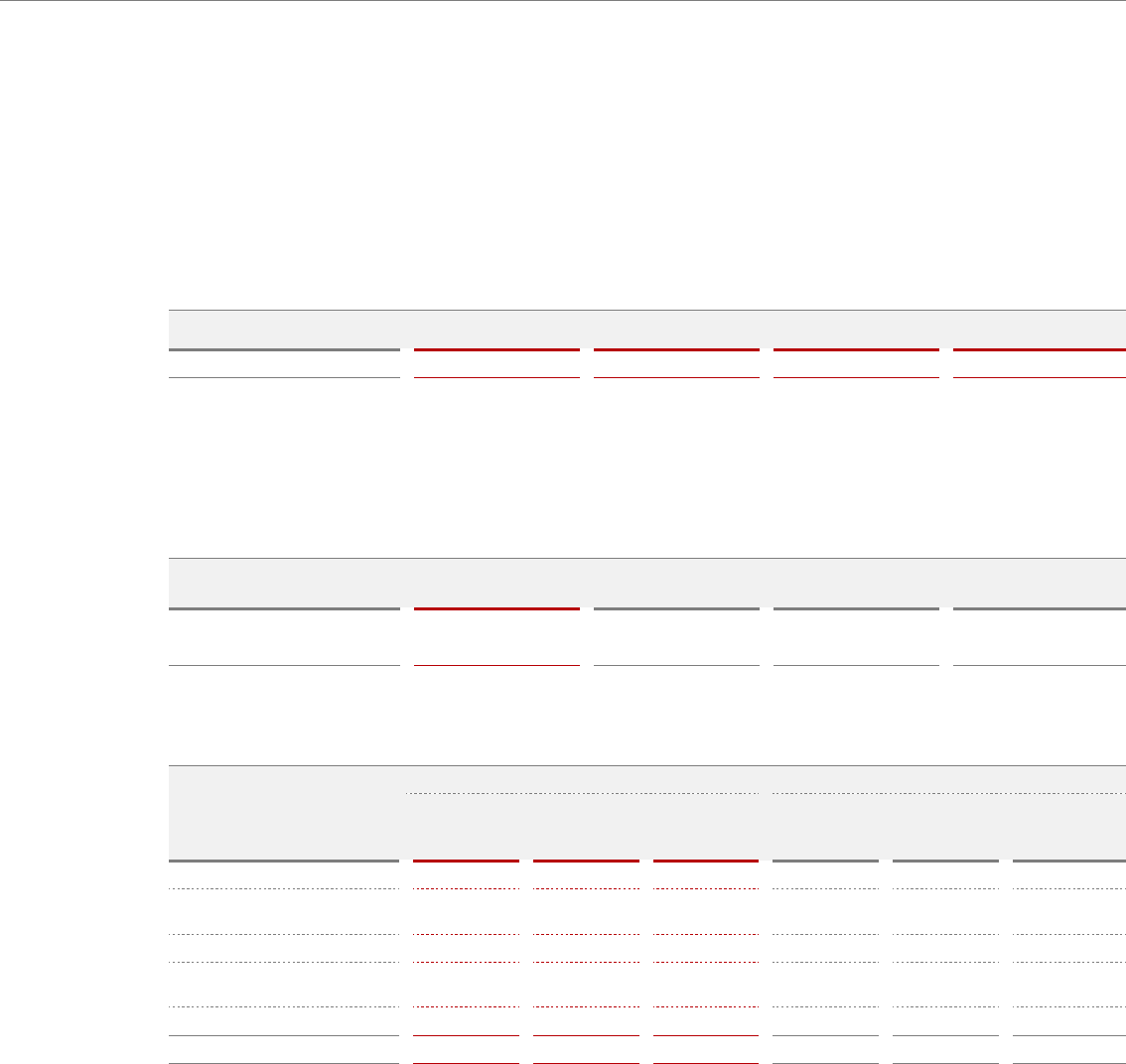

(iii) Financial instruments not measured at fair value, and for which fair value is disclosed

Financial instruments recognized by amortized cost, but presented as fair value classified by fair value hierarchy as of December 31, 2015 are

summarized as follows:

(In millions of won)

Level 1 Level 2 Level 3 Total

Bonds and borrowings

₩

- - 6,309,099 6,309,099

The Company has not disclosed the fair values for financial instruments, because their carrying amounts are a reasonable approximation of fair

values.

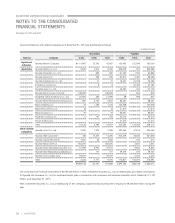

The valuation techniques and the significant unobservable inputs used in measuring Level 3 fair values as of December 31, 2015 are summarized

as follows:

(In millions of won)

Fair value Valuation methods Inputs

Significant

unobservable input

Bonds and borrowings

₩

6,309,099 DCF model Discount rate

considering credit risk

Discount rate

considering credit risk

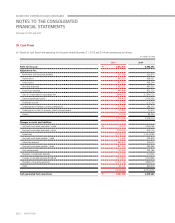

(f ) Income and expense by financial instruments category for the years ended December 31, 2015 and 2014 are summarized as follows:

(In millions of won)

2015 2014

Finance income

Finance

costs

Other

comprehensive

income

Finance

income

Finance

costs

Other

comprehensive

income

Loans and receivables

₩

195,504 85,364 - 231,121 52,843 -

Financial asset at fair value

through profit or loss 261 - - 56 - -

Available-for- sale financial assets 156,882 - (325,824) 15,831 557 45,954

Liabilities recognized

by amortized cost 5,365 190,517 - 2,358 113,788 -

Derivative financial instruments 1,555 44 430 1,448 2,157 -

₩

359,567 275,925 (325,394) 250,814 169,345 45,954

109

ANNUAL REPORT 2015 |