Kia 2015 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

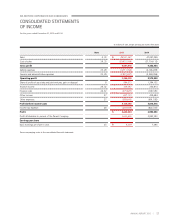

KIA MOTORS CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME

For the years ended December 31, 2015 and 2014

58 | KIA MOTORS

(In millions of won)

2015 2014

Profit ₩ 2,630,600 2,993,593

Other comprehensive income (loss) (net of tax):

Items that will never be reclassified subsequently to profit or loss:

Defined benefit plan remeasurements (60) (162,118)

Change in remeasurements of associates (3,056) (34,144)

Total items that will never be reclassified subsequently to profit or loss (3,116) (196,262)

Items that are or may be reclassified subsequently to profit or loss:

Change in fair value of available-for-sale financial assets (218,293) 45,954

Change in fair value of available-for-sale financial assets reclassified to profit or loss (107,531) -

Effective portion of changes in fair value of cash flow hedges 430 -

Change in capital adjustments - increase in gain of equity method accounted investments 18,515 (13,216)

Change in capital adjustments - increase in loss of equity method accounted investments (49,645) (106,195)

Foreign currency translation difference (525) (146,820)

Total items that are or may be reclassified subsequently to profit or loss (357,049) (220,277)

Other comprehensive loss for the period, net of income tax (360,165) (416,539)

Total comprehensive income for the period ₩ 2,270,435 2,577,054

Attributable to owners of the Parent Company 2,270,435 2,577,054

See accompanying notes to the consolidated financial statements.