Kia 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

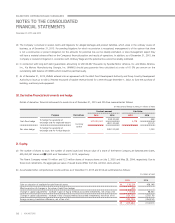

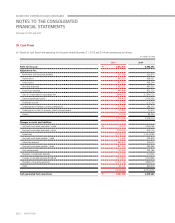

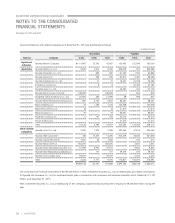

(d) Management of capital risk

The fundamental goal of capital management is to maintain on financial structure. As for this to be maintained, the Company use debt ratio

as indicator of capital management. The debt ratio is calculated as total liability divided by total equity.

32. Risk Management of Financial Instruments

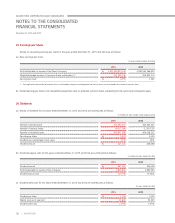

(a) Credit and counterparty risk

(i) Exposure to credit and counterparty risk

The carrying amount of financial assets means maximum exposure in respect of credit and counterparty risk. The maximum exposure as of

December 31, 2015 and 2014 are as follows:

(In millions of won)

2015 2014

Cash and cash equivalents (*)

₩

1,104,622 2,478,171

Short-term financial instruments 2,875,137 3,458,889

Short-term available-for-sale financial assets 2,872,648 1,176,358

Accounts and notes receivable – trade 2,388,911 2,419,265

Accounts and notes receivable – other 696,593 514,366

Other current assets 248,901 301,864

Long-term financial instruments 93,352 84,349

Long-term available-for-sale financial assets 225,049 260,324

Long-term accounts and notes receivable - trade 3,145 3,836

Guarantee deposits 171,553 168,929

Other non-current assets 106,739 102,692

₩

10,786,650 10,969,043

(*) Cash on hand is excluded.

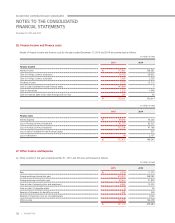

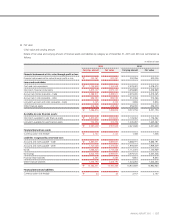

(ii) Loss on impairment

The carrying amount of trade account and notes receivable and other receivable based on by maturity as of December 31, 2015 and 2014 are as

follows:

(In millions of won)

2015 2014

Accounts and notes

receivable- trade Other receivable (*)

Accounts and notes

receivable- trade Other receivable (*)

Not overdue

₩

1,877,388 902,235 1,934,720 786,748

Past due less than 3 month 439,863 27,240 346,183 20,028

Past due 4~ 6 month 47,742 62,800 139,418 49,826

Past due 7~12 month 26,305 16,566 2,311 1,222

Past due over 12 month 97,714 5,988 99,132 29,089

₩

2,489,012 1,014,829 2,521,764 886,913

(*) Other receivables are comprised of other accounts and notes receivables, long-term other accounts and notes receivables, accrued income, short-term loans and guarantee deposits.

104 | KIA MOTORS

December 31, 2015 and 2014

KIA MOTORS CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED

FINANCIAL STATEMENTS