Kia 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company’s activities are exposed to a variety of financial risks: credit risk, liquidity risk and market risk (comprised of foreign

exchange risk and interest rate risk). The treasury department monitors and manages the financial risk arising from the Company’s

underlying operations in accordance with the risk management policies and procedures authorized by the board of directors.

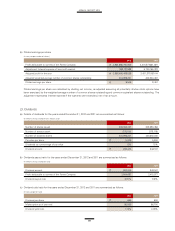

(a) Credit risk

Credit risk is the risk of financial loss to the Company if a customer or counterparty to a financial instrument fails to meet its

contractual obligations. The Company has transacted with customers before evaluating on their credit rating and have their

collaterals to control customers on default.

(b) Liquidity risk

Liquidity risk is the risk that the Company will encounter difficulty in meeting the obligations associated with its financial liabilities

that are settled by delivering cash or another financial asset. Management believes the Company maintains adequate sources of

liquidity to settle short-term financial liabilities. In addition, based on periodic analysis of expected cash outflows, the Company

also considers other alternatives, including seeking additional external financing or disposition of financial instruments for

investment purpose, to mitigate liquidity risk.

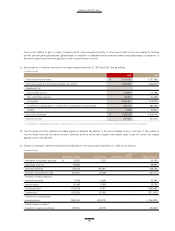

(c) Market risk

Market risk is the risk of fluctuations in fair value of financial instrument and future cash flow by changes of market price. The

purpose for managing market price is to optimize profits, while manage and control on exposure to market risk within acceptable

limits.

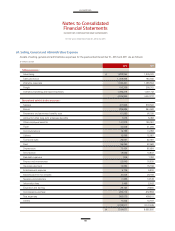

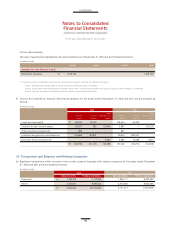

(i) Foreign exchange risk

The Company is exposed to foreign exchange risk arising from high proportion of export in sales amount, which is denominated in

foreign currencies. The Company’s primary exposure is to the US dollar and Euro and the Company manages to minimize financial

risk on fluctuations in foreign exchange in order to stabilize operating activities. The Company consistently evaluates on various

foreign exchange risk according to the Company’s own guideline for foreign exchange and transaction policy. If necessarily, the

Company may enter into foreign currency forwards contracts to hedge its foreign currency risk and strictly limit on speculative

transaction.

(ii) Interest rate risk

The Company’s asset and liability is exposed to interest rate risk on deposits and loans. In order to minimize actual Interest

cost, the Company continuously monitors current status of market interest rate, make a prediction on market data and reviews

on method for borrowing and joining financial instruments on deposit. Also, the Company’s management monitors the level of

interest rates and maintains the balance of borrowings at variable rates and fixed rates.

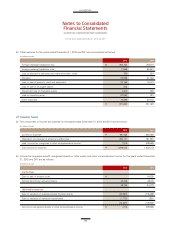

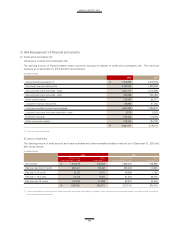

(d) Management of capital risk

The fundamental goal of capital management is to maintain on financial structure. As for this to be maintained, the Company use

debt ratio as indicator of capital management. The debt ratio is calculated as total liability divided by total equity.

For the years ended December 31, 2012 and 2011