Kia 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

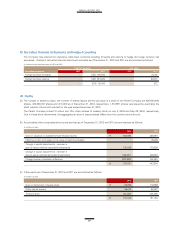

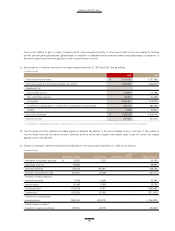

(a) The number of shares to issue, the number of shares issued and the par value of a share of the Parent Company are 820,000,000

shares, 405,363,347 shares and ₩ 5,000 as of December 31, 2012, respectively. 1,372,891 shares was issued by exercising the

stock warrant of bond with warrant for the year ended December 31, 2012.

The Parent Company retired 10 million and 12.5 million shares of treasury stock on July 2, 2003 and May 28, 2004, respectively.

Due to these stock retirements, the aggregate par value of issued shares differs from the common stock amount.

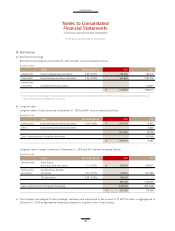

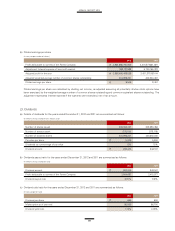

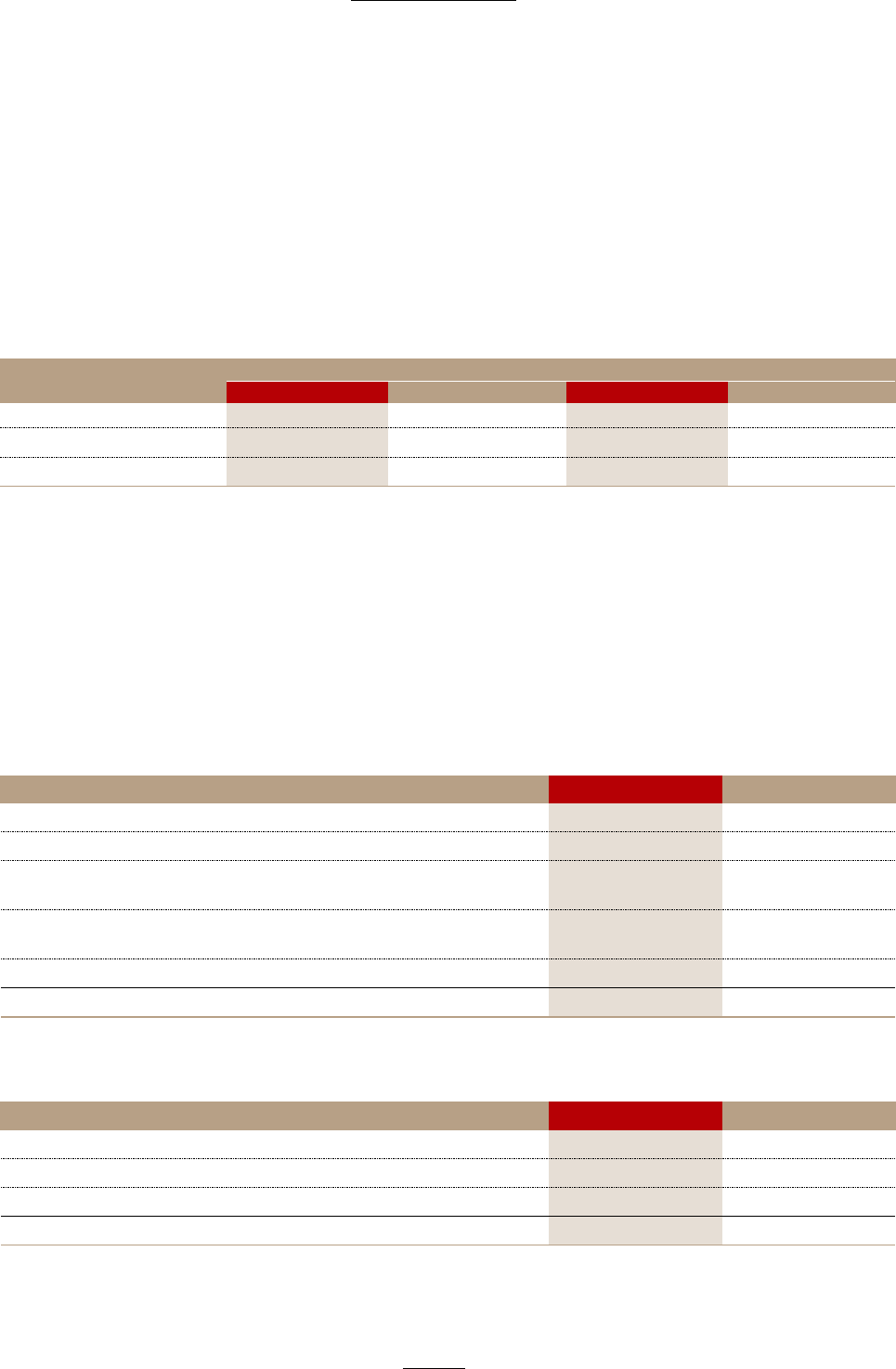

(b) Accumulated other comprehensive income and loss as of December 31, 2012 and 2011 are summarized as follows:

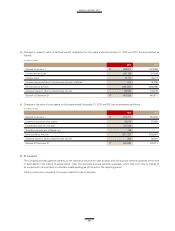

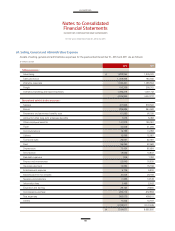

The Company has entered into derivative instrument contracts including forwards and options to hedge its foreign currency risk

exposures. Details of derivative financial instrument contracts as of December 31, 2012 and 2011 are summarized as follows:

(In millions of won and thousands of USD and EUR)

Contract amounts Fair value

Derivative instrument 2012 2011 2012 2011

Foreign currency forwards - USD 150,000 - (7,314)

Foreign currency options - USD 810,000 - (6,941)

- EUR 20,000 - 373

2012 2011

Gain on valuation of available-for-sale financial assets ₩ 553,593 426,551

Effective portion of changes in fair value of cash flow hedges - (5,543)

Change in capital adjustments - increase in

gain of equity method accounted investments 120,008 170,534

Change in capital adjustments - increase in

loss of equity method accounted investments (136,031) (94,807)

Foreign currency translation difference (203,539) (53,481)

₩ 334,031 443,254

(In millions of won)

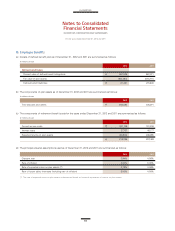

(c) Other equity as of December 31, 2012 and 2011 are summarized as follows:

2012 2011

Gain on retirement of capital stock ₩ 119,859 119,859

Other capital surplus 55,613 55,907

Treasury stock (24,432) (24,432)

₩ 151,040 151,334

(In millions of won)