Kia 2012 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

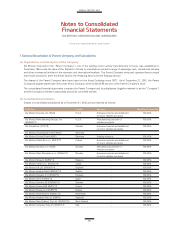

The significant accounting policies applied by the Company in preparation of its consolidated financial statements are included

below. The accounting policies set out below have been applied consistently to all periods presented in these consolidated financial

statements except those as disclosed in note 2(e).

(a) Basis of consolidation

SUBSIDIARIES Subsidiaries are entities controlled by the Company. Control exists when the Company has the power to govern

the financial and operating policies of the other entity so as to obtain benefits from its activities. The existence and effect of

potential voting rights that are currently exercisable or convertible are considered when assessing whether the Company controls

another entity. The financial statements of subsidiaries are included in the consolidated financial statements from the date that

control commences until the date that control ceases.

If a member of the Company uses accounting policies other than those adopted in the consolidated financial statements for like

transactions and events in similar circumstances, appropriate adjustments are made to its financial statements in preparing the

consolidated financial statements.

INTRA-GROUP TRANSACTIONS Intra-group balances and transactions, and any unrealized income and expenses arising from

intra- group transactions, are eliminated in preparing the consolidated financial statements. Intra-group losses are recognized as

expense if intra-group losses indicate an impairment that requires recognition in the consolidated financial statements.

NON-CONTROLLING INTERESTS Non-controlling interests in a subsidiary are accounted for separately from the Company’s

ownership interests in a subsidiary. Each component of net profit or loss and other comprehensive income is attributed to the

owners of the Company and non-controlling interest holders, even when the allocation reduces the non-controlling interest balance

below zero.

CHANGES IN THE COMPANY’S OWNERSHIP INTEREST IN A SUBSIDIARY Changes in the Company’s ownership interest

in a subsidiary that do not result in a loss of control are accounted for as equity transactions with owners in their capacity as owners.

Adjustments to non-controlling interests are based on a proportionate amount of the net assets of the subsidiary. The difference

between the consideration and the adjustments made to non-controlling interest is recognized directly in equity attributable to the

owners of the Company.

(b) Business Combination

BUSINESS COMBINATION A business combination is accounted for by applying the acquisition method, unless it is a

combination involving entities or businesses under common control.

Each identifiable asset and liability is measured at its acquisition-date fair value except for below:

- Only those contingent liabilities assumed in a business combination that are a present obligation and can be measured reliably

are recognized

- Deferred tax assets or liabilities are recognized and measured in accordance with K-IFRS No. 1012 Income Taxes

- Employee benefit arrangements are recognized and measured in accordance with K-IFRS No.1019 Employee Benefits

As of the acquisition date, non-controlling interests in the acquiree are measured as the non-controlling interests’ proportionate

share of the acquiree’s identifiable net assets.

The consideration transferred in a business combination shall be measured at fair value, which shall be calculated as the sum of

the acquisition-date fair values of the assets transferred by the acquirer, the liabilities incurred by the acquirer to former owners of

the acquiree and the equity interests issued by the acquirer. However, any portion of the acquirer’s share-based payment awards

exchanged for awards held by the acquiree’s employees that is included in consideration transferred in the business combination

shall be measured in accordance with the method described above rather than at fair value.

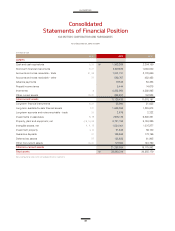

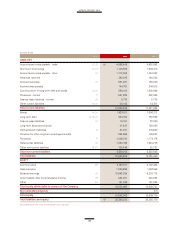

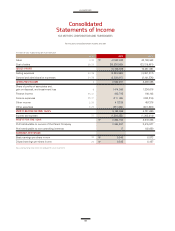

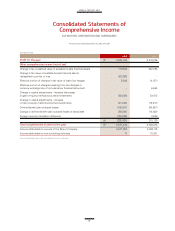

For the years ended December 31, 2012 and 2011