Kia 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(y) Operating segments

An operating segment is a component of the Company that: 1) engages in business activities from which it may earn revenues and

incur expenses, including revenues and expenses that relate to transactions with other components of the Company, 2) whose

operating results are reviewed regularly by the Company’s chief operating decision maker (‘CODM’) in order to allocate resources

and assess its performance, and 3) for which discrete financial information is available.

Management has determined that the CODM of the Company is the CEO. The CODM does not receive and therefore does not

review discrete financial information for any component of the Company. Consequently, no operating segment information is

included in these consolidated financial statements. Entity wide disclosures of geographic and product revenue information are

provided in note 4 to the consolidated financial statements.

(z) New standards and interpretations not yet adopted

The following new standards, interpretations and amendments to existing standards have been published and are mandatory for

the Company for annual periods beginning after January 1, 2012, and the Company has not early adopted them. Management

believes the impact of the amendments on the Company’s consolidated financial statements is not significant.

(i) K-IFRS No.1110, ‘Consolidated Financial Statements’

The standard introduces a single control model to determine whether an investee should be consolidated. The standards are

effective for annual periods beginning on or after January 1, 2013 with early adoption permitted.

(ii) K-IFRS No.1111, ‘Joint Arrangements’

The standard classifies joint arrangements into two types - joint operations and joint ventures. A joint operation is a joint

arrangement whereby the parties that have joint control of the arrangement (i.e. joint operators) have rights to the assets, and

obligations for the liabilities, relating to the arrangement. A joint venture is a joint arrangement whereby the parties that have

joint control of the arrangement (i.e. joint venturers) have rights to the net assets of the arrangement. The standard requires a

joint operator to recognize and measure the assets and liabilities (and recognize the related revenues and expenses) in relation

to its interest in the arrangement in accordance with relevant IFRSs applicable to the particular assets, liabilities, revenues and

expenses. The standard requires a joint venturer to recognize an investment and to account for that investment using the equity

method. The standards are effective for annual periods beginning on or after January 1, 2013 with early adoption permitted.

(iii) K-IFRS No.1112, ‘Disclosure of Interests in Other Entities’

The standard brings together into a single standard all the disclosure requirements about an entity’s interests in subsidiaries,

joint arrangements, associates and unconsolidated structured entities. The Company is currently assessing the disclosure

requirements for interests in subsidiaries, interests in joint arrangements and associates and unconsolidated structured entities

in comparison with the existing disclosures. The standard requires the disclosure of information about the nature, risks and

financial effects of these interests. The standards are effective for annual periods beginning on or after January 1, 2013 with early

adoption permitted.

(iv) Amendments to K-IFRS No. 1019, ‘Employee Benefits’

The standard requires recognition of actuarial gains and losses immediately in other comprehensive income and to calculate

expected return on plan assets based on the rate used to discount the defined benefit obligation. The standard will be applied

retrospectively for the Company’s annual periods beginning on or after January 1, 2013.

(vi) Amendments to K-IFRS No. 1001, ‘Presentation of Financial Statements’

The amendments require presenting in other comprehensive income on the basis of whether they are potentially reclassifiable to

profit or loss subsequently (reclassification adjustments). The amendment is mandatorily effective for annual periods beginning

on or after July 1, 2012.

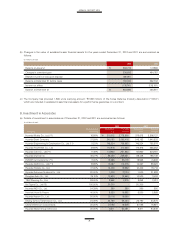

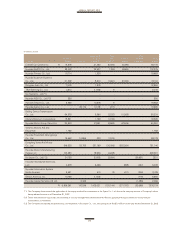

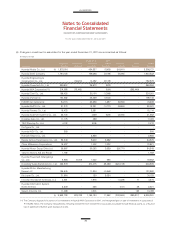

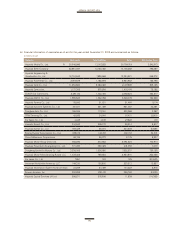

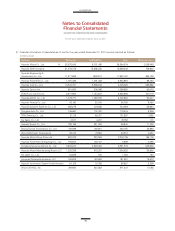

For the years ended December 31, 2012 and 2011