Kia 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

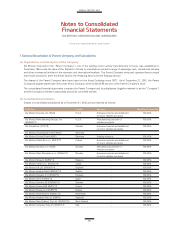

Depreciation methods, useful lives and residual values are reviewed at the end of each reporting date and adjusted, if appropriate.

The change is accounted for as a change in an accounting estimate.

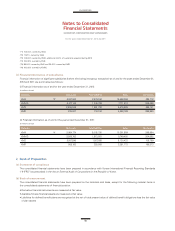

(k) Borrowing costs

The Company capitalizes borrowing costs directly attributable to the acquisition, construction or production of a qualifying asset

as part of the cost of that asset. Other borrowing costs are recognized in expense as incurred. A qualifying asset is an asset

that requires a substantial period of time to get ready for its intended use or sale. Financial assets and inventories that are

manufactured or otherwise produced over a short period of time are not qualifying assets. Assets that are ready for their intended

use or sale when acquired are not qualifying assets.

(l) Intangible assets

Intangible assets are measured initially at cost and, subsequently, are carried at cost less accumulated amortization and

accumulated impairment losses.

Amortization of intangible assets except for goodwill is calculated on a straight-line basis over the estimated useful lives of

intangible assets from the date that they are available for intented use. The residual value of intangible assets is zero. However, as

there are no foreseeable limits to the periods over which memberships are expected to be available for use, this intangible asset is

determined as having indefinite useful lives and not amortized.

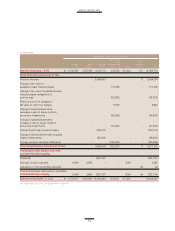

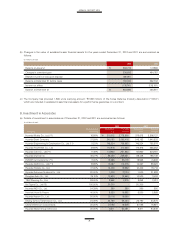

The estimated useful lives for the current and comparative periods are as follows:

Amortization periods and the amortization methods for intangible assets with finite useful lives are reviewed at the end of each

reporting period. The useful lives of intangible assets that are not being amortized are reviewed at the end of each reporting period

to determine whether events and circumstances continue to support indefinite useful life assessments for those assets. Changes

are accounted for as changes in accounting estimates.

RESEARCH AND DEVELOPMENT Expenditures on research activities, undertaken with the prospect of gaining new scientific

or technical knowledge and understanding, is recognized in profit or loss as incurred. Development expenditures are capitalized

only if development costs can be measured reliably, the product or process is technically and commercially feasible, future economic

benefits are probable, and the Company intends to and has sufficient resources to complete development and to use or sell the

asset. Other development expenditures are recognized in profit or loss as incurred.

SUBSEQUENT EXPENDITURES Subsequent expenditures are capitalized only when they increase the future economic benefits

embodied in the specific asset to which it relates. All other expenditures, including expenditures on internally generated goodwill

and brands, are recognized in profit or loss as incurred.

(m)

Investment property

Property held for the purpose of earning rentals or benefiting from capital appreciation is classified as investment property.

Investment property is measured initially at its cost. Transaction costs are included in the initial measurement. Subsequently,

investment property is carried at depreciated cost less any accumulated impairment losses.

Estimated useful lives (years)

Intellectual property rights 5, 10

Software 5

Development costs (*)

Country club membership and golf club membership Indefinite

(*) Capitalized development costs are amortized over the useful life considering the life cycle of the developed products.