Kia 2012 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

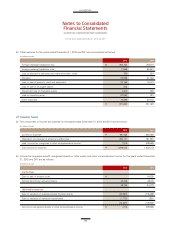

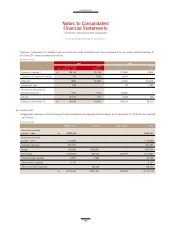

(ii) Aggregate maturities of the Company’s financial liabilities, including estimated interest, as of December 31, 2011 are

summarized as follows:

(In millions of won)

Accounts and notes

payable - trade ₩ 4,825,992 - - 4,825,992

Accounts and notes

payable - other 1,744,387 - - 1,744,387

Accrued expenses 799,220 - - 799,220

Bonds 1,200,122 1,767,182 103,783 3,071,087

Borrowings 2,045,960 622,457 205,749 2,874,166

Financial lease liabilities 6,943 25,044 - 31,987

Other current liabilities 52,511 - - 52,511

Other non-current liabilities - 20,727 - 20,727

₩ 10,675,135 2,435,410 309,532 13,420,077

Within 1 year 1~5 years Over 5 years Total

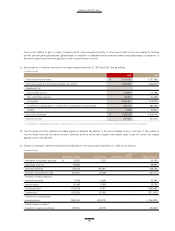

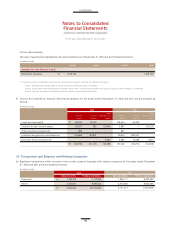

(c) Foreign exchange risk

The Company’s capital and income (loss) would have been increased or decreased, if the foreign exchange rate against USD and

EUR were higher. The Company assumes that interest rate fluctuates 10% at year ended period. Also, the Company assumes that

others variables such as interest rate are not changed by sensitive analysis. The Company analyzed by the same method as used

for last period and details for the effect on income before taxes are summarized as follows:

(d) Interest rate risk

Sensitivity analysis of interest expenses and interests income for the year from changes of interests rate for the years ended

December 31, 2012 and 2011 are as summarized as follows:

(In millions of won)

(In millions of won)

2012 2011

10% Up 10% Down 10% Up 10% Down

USD ₩ (154,569) 154,569 (86,354) 86,354

EUR 983 (983) (31,217) 31,217

2012 2011

100 bps Up 100 bps Down 100 bps Up 100 bps Down

Interest income ₩ 19,023 (19,023) 21,183 (21,183)

Interest expense 11,756 (11,756) 16,728 (16,728)