Kia 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

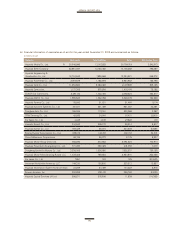

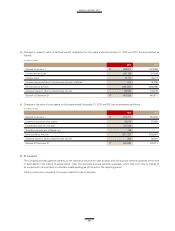

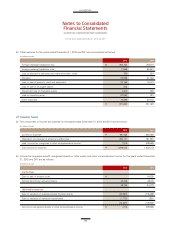

(f) Changes in fair value of plan assets for the years ended December 31, 2012 and 2011 are summarized as follows:

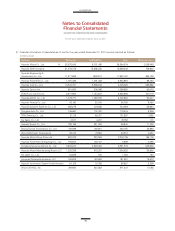

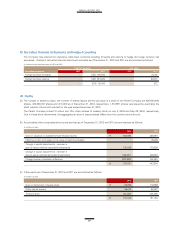

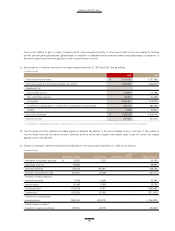

(e) Changes in present value of defined benefit obligations for the years ended December 31, 2012 and 2011 are summarized as

follows:

2012 2011

Balance at January 1 ₩ 674,271 973,230

Expected returns on plan assets 26,516 32,685

Contribution paid into the plan 470,000 -

Transference between affiliates, net 129 -

Benefit paid by the plan (231,132) (325,597)

Actuarial losses in other comprehensive income 300 (6,047)

Balance at December 31 ₩ 940,084 674,271

2012 2011

Balance at January 1 ₩ 948,871 1,037,965

Current service costs 201,105 191,916

Interest costs 37,737 48,177

Increase (decrease) due to transference between affiliates 214 (6,176)

Benefit paid by the plan (423,445) (426,226)

Actuarial losses in other comprehensive income 197,053 103,215

Balance at December 31 ₩ 961,535 948,871

(In millions of won)

(In millions of won)

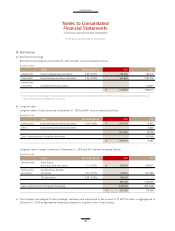

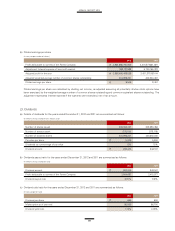

The Company provides general warranty to the ultimate consumer for each product sold and accrues warranty expense at the time

of sale based on the history of actual claims. Also, the Company accrues potential expenses, which may occur due to change of

fix component of any product or voluntary recalls pending as of the end of the reporting period.

Other provision are comprised of provision related to loss on lawsuits.