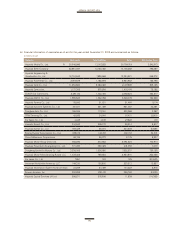

Kia 2012 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

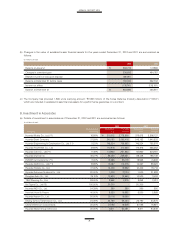

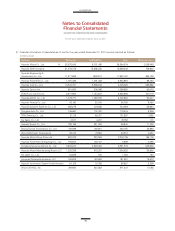

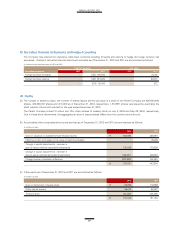

(b) Changes in investment property for the year ended December 31, 2012 are summarized as follows:

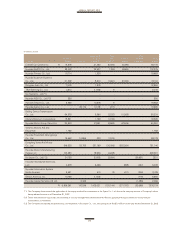

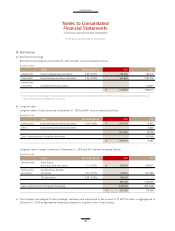

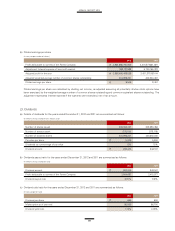

(c) Changes in investment property for the year ended December 31, 2011 are summarized as follows:

Beginning balance Depreciation Other Ending balance

Beginning balance Depreciation Other Ending balance

Land ₩ 21,995 - (1,167) 20,828

Buildings 34,105 (1,123) (2,376) 30,606

₩ 56,100 (1,123) (3,543) 51,434

Land ₩ 21,720 - 275 21,995

Buildings 35,043 (1,105) 167 34,105

₩ 56,763 (1,105) 442 56,100

(In millions of won)

(In millions of won)

(d) The amount recognized in profit or loss from investment property for the years ended December 31, 2012 and 2011 are

summarized as follows:

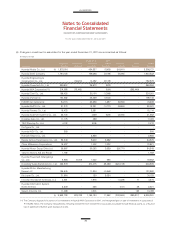

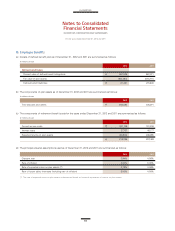

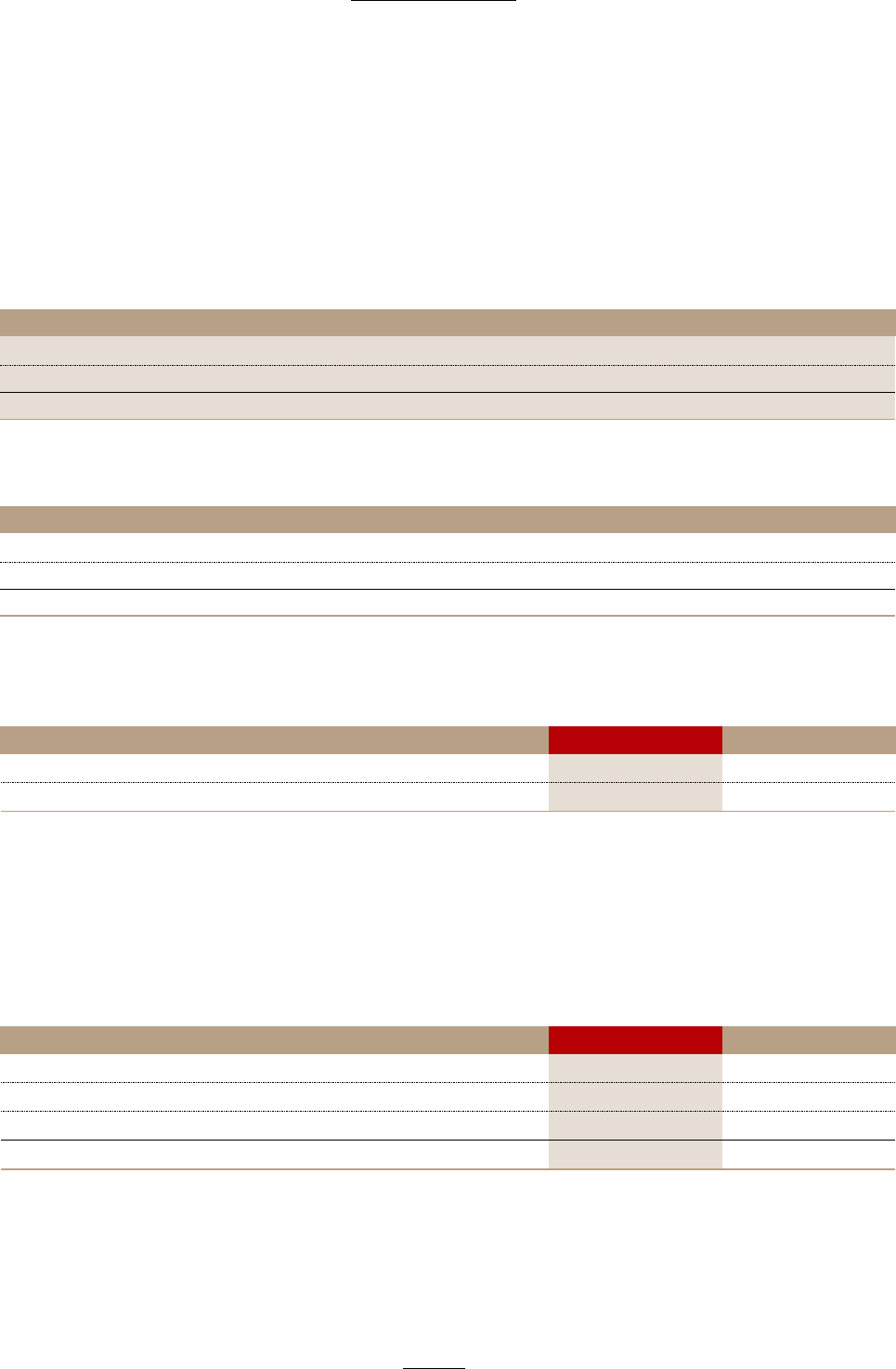

(a) Changes in goodwill for the years ended December 31, 2012 and 2011 are summarized as follows:

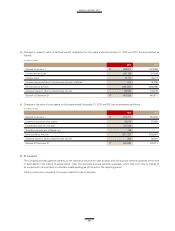

(e) Land and buildings held for the purpose of earning rentals are classified as investment property. In addition, the fair value of

investment property doesn’t differ from its book value significantly as of December 31, 2012.

(b) Goodwill is allocated to each CGU(Cash Generating Unit) that is expected to benefit from each operating unit. The Company

estimated the recoverable amount of CGU as its value in use calculated by discounting the future cash flows to be generated on

the basis of business plan approved by CEO in five years. Cash flows expected to be generated after five years were estimated

within the scope of not to exceed long term average growth rate of industry.

2012 2011

Rental income ₩ 5,770 3,779

Operating expense 1,930 1,894

2012 2011

Balance at January 1 ₩ 36,287 23,320

Increase due to business combination - 14,045

Other decrease (99) (1,078)

Balance at December 31 ₩ 36,188 36,287

(In millions of won)

(In millions of won)