Kia 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

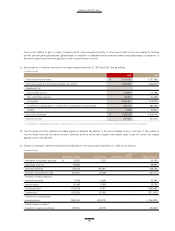

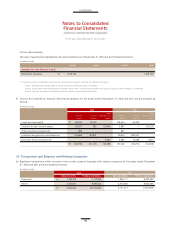

(ii) Interest rates used for determining fair value

The interest rates used to discount estimated cash flows, when applicable, are based on the government yield curve at the

reporting date plus an adequate credit spread. The interest rates used as of December 31, 2012 and 2011 are summarized as

follows:

2012 2011

Carrying amount Fair value Carrying amount Fair value

Currency forward (hedge) ₩ - - 7,314 7,314

Currency option (hedge) - - 10,088 10,088

₩ - - 17,402 17,402

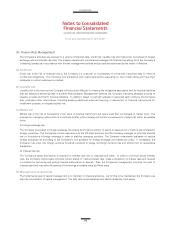

The Company measured the fair value of financial instruments as follows:

- The fair value of available-for-sale financial assets traded within the market is measured at the closing bid price quoted at the end

of the reporting period.

- The fair value of the derivatives is the present value of the difference between contractual forward price and future forward price

discounted during the remaining period of the contract, from present to contractual maturity.

The fair value of current receivables is close to their carrying amounts. In addition, the fair value of other financial instruments is

determined as the present value of estimated future cash flows discounted at the current market interest rate. As of December

31, 2012, there isn’t any significant business climate and economic environment changes affecting the fair value of financial assets

and liabilities.

2012 2011

Derivatives - 3.22~3.30%

Debts and Bonds 3.08% 3.41%