Kia 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

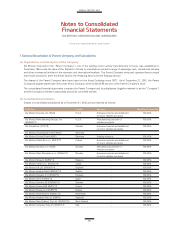

(c) Functional and presentation currency

The consolidated financial statements are presented in Korean won, which is the Parent Company’s functional currency and the currency of

the primary economic environment in which the Company operates.

(d) Use of estimates and judgments

The preparation of the consolidated financial statements in conformity with K-IFRS requires management to make judgments,

estimates and assumptions that affect the application of accounting policies and the reported amounts of assets, liabilities, income

and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the

period in which the estimates are revised and in any future periods affected.

Information about assumptions and estimation uncertainties that have a significant risk of resulting in a material adjustment within

the next fiscal year are included in the following notes:

• Note 16 : Employee Benefits

• Note 17 : Provisions

• Note 18 : Commitments and Contingencies

• Note 27 : Income Taxes

(e) Changes in accounting policies

(i) Changes in accounting policies

① Financial Instruments: Disclosures

The Company has applied the amendments to K-IFRS No.1107, ‘Financial Instruments: Disclosures’ since January 1, 2012. The

amendments require disclosing the nature of transferred assets, their carrying amount, and the description of risks and rewards

for each class of transferred financial assets that are not derecognized in their entirety. If the Company derecognizes transferred

financial assets but still retains their specific risks and rewards, the amendments require additional disclosures of their risks.

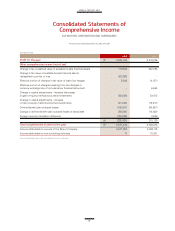

② Presentation of financial statements

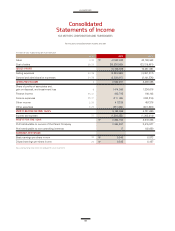

The Company adopted the amendments to K-IFRS No. 1001, ‘Presentation of Financial Statements’ from the annual period ended

December 31, 2012. The Company’s operating profit is calculated as revenue less: (1) cost of goods sold, and (2) selling, general

and administrative expenses, and is presented separately in the consolidated statement of income.

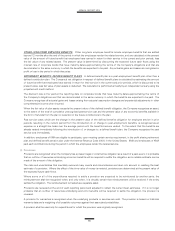

(ii) Impact of change in accounting policy

The Company retrospectively applied the amendment to K-IFRS No. 1001, for which the impact is as follows:

2012 2011

Operating profit before adoption of the amendments

₩

3,558,326 3,525,146

Changes :

Other income (Note 26) (417,339) (457,378)

Other expense (Note 26) 381,264 431,320

Operating profit after adoption of the amendments

₩

3,522,251 3,499,088

(In millions of won)