Kia 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

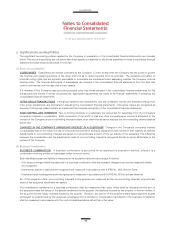

liabilities at fair value through profit or loss are measured at fair value, and changes therein are recognized in profit or loss. Upon initial

recognition, transaction costs that are directly attributable to the acquisition are recognized in profit or loss as incurred.

OTHER FINANCIAL LIABILITIES Non-derivative financial liabilities other than financial liabilities at fair value through profit or

loss are classified as other financial liabilities. At the date of initial recognition, other financial liabilities are measured at fair value

minus transaction costs that are directly attributable to the acquisition. Subsequent to initial recognition, other financial liabilities

are measured at amortized cost using the effective interest method.

The Company derecognizes a financial liability from the consolidated statements of financial position when it is extinguished (i.e.

when the obligation specified in the contract is discharged, cancelled or expires).

(h) Derivative financial instruments, including hedge accounting

Derivatives are initially recognized at fair value. Subsequent to initial recognition, derivatives are measured at fair value, and

changes therein are either recognized in profit or loss or, when the derivatives are designated in a hedging relationship and the

hedge is determined to be an effective hedge, other comprehensive income.

(i) Hedge accounting

The Company holds forward exchange contracts, currency options and other derivative contracts to manage foreign exchange

risk. The Company designated derivatives as hedging instruments to hedge the foreign currency risk of highly probable forecasted

transactions(a cash flow hedge).

On initial designation of the hedge, the Company formally documents the relationship between the hedging instrument(s) and

hedged item(s), including the risk management objectives and strategy in undertaking the hedge transaction, together with the

methods that will be used to assess the effectiveness of the hedging relationship. The Company makes an assessment, both at

the inception of the hedge relationship as well as on an ongoing basis, whether the hedging instruments are expected to be “highly

effective” in offsetting the changes in the cash flows of the respective hedged items during the period for which the hedge is

designated.

CASH FLOW HEDGE When a derivative is designated to hedge the variability in cash flows attributable to a particular risk

associated with a recognized asset or liability or a highly probable forecasted transaction that could affect profit or loss, the effective

portion of changes in the fair value of the derivative is recognized in other comprehensive income, net of tax, and presented in the

hedging reserve in equity. Any ineffective portion of changes in the fair value of the derivative is recognized immediately in profit or

loss.

If the hedging instrument no longer meets the criteria for hedge accounting, expires or is sold, terminated, exercised, or the

designation is revoked, then hedge accounting is discontinued prospectively. The cumulative gain or loss on the hedging

instrument that has been recognized in other comprehensive income is reclassified to profit or loss in the periods during which

the forecasted transaction occurs. If the forecasted transaction is no longer expected to occur, then the balance in other

comprehensive income is recognized immediately in profit or loss.

(ii) Other derivative financial instruments

Changes in the fair value of other derivative financial instrument not designated as a hedging instrument are recognized

immediately in profit or loss.

(i) Impairment of financial assets

A financial asset not carried at fair value through profit or loss is assessed at each reporting date to determine whether there is

objective evidence that it is impaired. A financial asset is impaired if objective evidence indicates that a loss event has occurred

after the initial recognition of the asset, and that the loss event had a negative effect on the estimated future cash flows of that

asset that can be estimated reliably. However, losses expected as a result of future events, regardless of likelihood, are not

recognized. In addition, for an investment in an equity security, a significant or prolonged decline in its fair value below its cost is

objective evidence of impairment.

If financial assets have objective evidence that they are impaired, impairment losses should be measured and recognized.